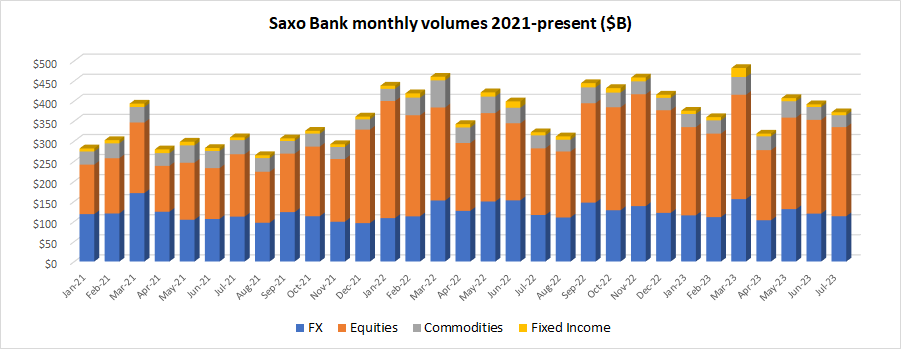

Saxo Bank client trading volumes fall 5% in July 2023

Copenhagen based Retail FX and CFDs broker Saxo Bank has reported its trading volume metrics for July 2023, indicating a 5% MoM drop in overall client activity. That follows what was a fairly slow first half of 2023 at Saxo Bank, with volumes down 4% from 2022 levels.

Overall, client trading volumes at Saxo Bank totaled $371.9 billion in July 2023, down by 5% from June’s $391.7 billion. All of Saxo’s offered traded asset classes saw a decline in activity in July, except Fixed Income. Core FX trading volumes were down by 6% to $112.9 billion.

Client trading volumes at Saxo Bank in July 2023 were as follows:

- FX trading down 6% MoM to $112.9 billion.

- Equities down 5% to $222.1 billion.

- Commodities trading down 8% to $29.6 billion.

- Fixed income trading up 11% to $7.3 billion.

Saxo Bank is controlled by China’s Geely Group.