Public.com makes Treasury Accounts available to all Public members

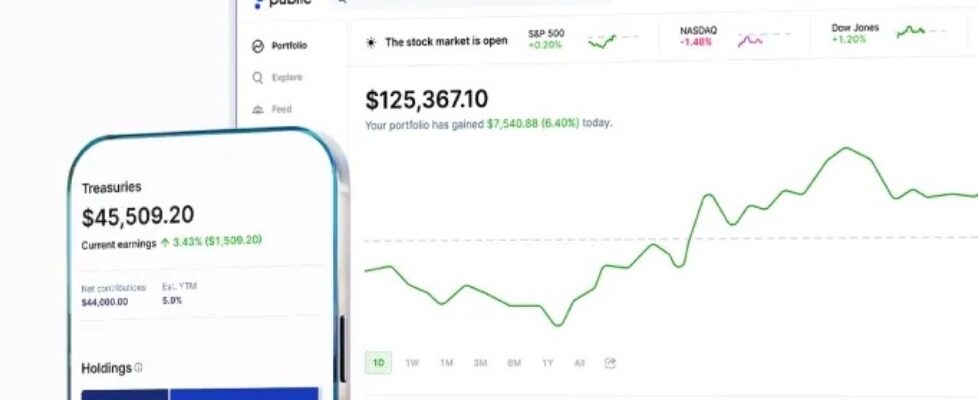

Today, Public.com announced that Treasury Accounts are available to all Public members. Members can now take advantage of the current 5.1% yield of Treasury bills, while also receiving the flexibility and ease of access to cash of a typical bank account.

In 2023, Public members have shown an increasing interest in fixed-income assets as they look to create more balance and stability in their portfolios. Public.com is introducing Treasury Accounts to meet this demand, offering members a low-risk, high-yielding account where they can park their cash — all in the same platform where they can also invest in stocks, ETFs, crypto, and alternative assets.

Treasury bills, or T-bills, are short-term debt securities issued by the US Treasury with maturity periods ranging from 4 to 52 weeks. T-bills are purchased at a discount to their face value and paid back in full when they reach maturity. When you purchase a T-bill, you essentially lend money to the government for a specified period of time to support various public projects, and in return, you get a yield, which is like interest on your loan.

A Treasury Account is a new account type from Public that allows members to easily put their cash in US Treasuries and earn a secure, fixed yield.

When you deposit into a Treasury Account on Public, it is immediately invested into 26-week T-bills. These T-bills are automatically reinvested at maturity to ensure compounding yield, and because T-bills are a fixed-rate asset, your yield is locked in at the time of your deposit.

T-bills are held in custody at The Bank of New York Mellon. If you need access to your funds, you can sell your T-bills at any time — even before maturity.

Deposits can be made with as little as $100, and anytime you make an additional deposit, your funds will be used to purchase the most recent T-bill. You can track the yield of all of your T-bills directly on Public.

Treasury Accounts on Public are powered by Public’s partnership with Jiko, a financial network for money storage and movement, and registered broker-dealer, member FINRA and SIPC.