Plus500 sees revenue edge higher in Q1 2024

Retail FX and CFD broker Plus500 Ltd (LON:PLUS) today provided a trading update for the three months ended 31 March 2024.

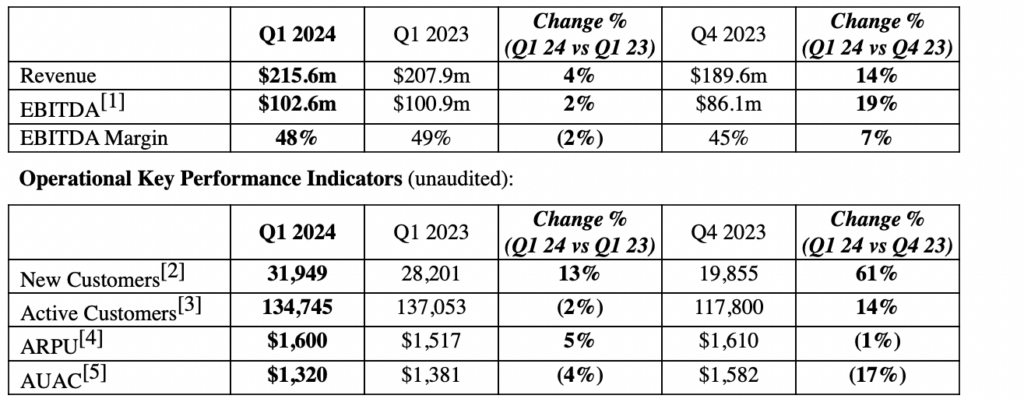

Plus500 delivered strong financial and operational results for the first quarter of 2024. Revenue and EBITDA increased year-on-year to $215.6m (Q1 2023: $207.9m) and $102.6m (Q1 2023: $100.9m), respectively. Within Group revenue, trading income was $200.2m and interest income was $15.4m.

The Group onboarded 31,949 New Customers in Q1 2024 (Q1 2023: 28,201), representing growth of 13% year-on-year. Active Customers stood at 134,745 in Q1 2024 (Q1 2023: 137,053).

Customer deposits were $0.7bn (Q1 2023: $0.6bn) and the average deposit per Active Customer increased by 27% to approximately $5,400 in Q1 2024 (Q1 2023: approximately $4,250), highlighting customers’ on-going loyalty and confidence in Plus500’s technology, diverse product portfolio and excellent customer experience.

Average revenue per user (ARPU) increased by 5% to $1,600 in Q1 2024 (Q1 2023: $1,517).

Average user acquisition cost (AUAC) was broadly flat during Q1 2024 at $1,320 (Q1 2023: $1,381), and fell materially quarter-on-quarter by 17%.

During Q1 2024 the company repurchased 1,483,445 shares, at an average price of £17.66, for a total cash consideration of $33.3m. As at 31 March 2024, the remaining number of the company’s ordinary shares in issue was 78,234,595.

Plus500’s strategic roadmap is designed to position the Group for key growth opportunities, including new products, services and markets, as well as the expansion of its core OTC product offering, share dealing, futures and options on futures products and by deepening its customer engagement and retention initiatives.

The Board expects that the FY 2024 results will be ahead of current market expectations.

David Zruia, Chief Executive Officer of Plus500, commented:

“Thanks to our established competitive advantages, continued strategic progress and robust financial position, Plus500 generated another set of strong operational and financial results during the period.

We continued to deliver against our strategic roadmap; expanding into new markets, developing new products and deepening relationships with our customers. In the US futures market, our B2B (Institutional) business will soon launch an innovative new technological offering and we have secured an additional full clearing membership to further enhance our clearing services. Our B2C (Retail) business is performing extremely well, ahead of management’s expectations, and its contribution to the recruitment of new customers is already not insignificant.

As a diversified, global business with a clear and proven strategy, Plus500 is well positioned to continue delivering strong results and attractive returns to its shareholders.”