Plus500 registers 16% increase in revenues in FY 2022

Online trading company Plus500 Ltd (LON:PLUS) today announced its unaudited preliminary results for the year ended 31 December 2022.

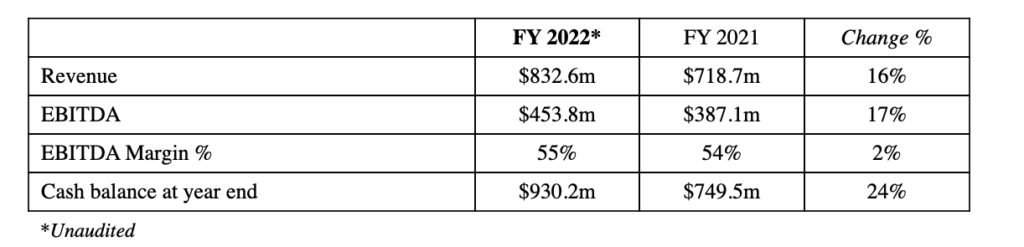

The Group generated total revenue in FY 2022 of $832.6 million, representing a 16% increase year-on-year (FY 2021: $718.7m), including revenue of $126.7m in Q4 2022 (Q4 2021: $161.1m). This is in line with data provided in January 2023.

EBITDA for FY 2022 increased by 17% to $453.8 million (FY 2021: $387.1m), including $46.7 million in Q4 2022 (Q4 2021: $70.9m). EBITDA margin increased during FY 2022 to 55% (FY 2021: 54%).

Net profit in FY 2022 increased by 19% to $370.4 million (FY 2021: $310.6m) and basic earnings per share increased by 25% to $3.81 (FY 2021: $3.06).

Customer Income, a key measure of the Group’s underlying performance, amounted to $639.6m (FY 2021: $702.8m), including $150.4m in Q4 2022 (Q4 2021: $166.7m). Customer Trading Performance was $193.0m during FY 2022 (FY 2021: $15.9m), including $(23.7m) in Q4 2022.

Plus500 continues to expect that the contribution from Customer Trading Performance will be broadly neutral over time.

Financial income, net, for FY 2022 was $23.9m (FY 2021: $1.8m), mainly as a result of developments in the global interest rate environment and its positive impact on the Group’s cash balances.

In addition, in order to manage the exposure between the US dollar, as the functional currency of the Group, to the other range of currencies applicable to the Group’s operations, a substantial proportion of the Group’s cash is held in US dollar, to reduce the impact on financial exposure. This approach also enabled the Group’s strong financial income performance.

In the US market, the Group is targeting several significant growth opportunities and, to this end, made excellent progress in FY 2022. This progress was supported also by the Group’s new partnership with the NBA Chicago Bulls, announced during the year, which will drive brand awareness for Plus500, both in the attractive US market and globally.

The Group also developed a new B2B line of business and a strategic position as a market infrastructure provider, with a view to delivering brokerage-execution and clearing services for institutional clients. The Group’s future progress in the institutional market will be driven by Plus500’s operational capabilities, proprietary technology and the Group’s robust financial position.

Furthermore, the Group’s proposition in this new line of business is further strengthened by its position as a full clearing member of the CME Group exchanges and the Minneapolis Grain Exchange (MGEX), which were achieved during the year.

In Q3 2022, Plus500 launched a new B2C proprietary trading platform – ‘TradeSniper’, an intuitive proprietary futures trading platform specifically tailored for the sizeable and latent US retail trading market.

The Group says it will continue to allocate the appropriate financial, operational and human resources to maximise these significant opportunities in the US over the medium term.

In FY 2022, Plus500 completed the acquisition of a regulated entity in Japan, for which integration plans are progressing well. Over time, this will enable the Group to access the substantial Japanese trading market, where Plus500 will apply its considerable technological capabilities and financial strength to build locally its market position.

The Group’s proprietary share dealing platform, ‘Plus500 Invest’, was launched in Europe on Android and iOS mobile apps during the year. This product further drives the expansion of the Group’s product range and geographic footprint, as well as improves customer retention and diversifies Plus500’s revenue base.