Plus500 marks growth in revenue, EBITDA in H1 2025

Retail FX and CFD broker Plus500 Ltd (LON:PLUS) today published its interim results for the six-month period ended 30 June 2025.

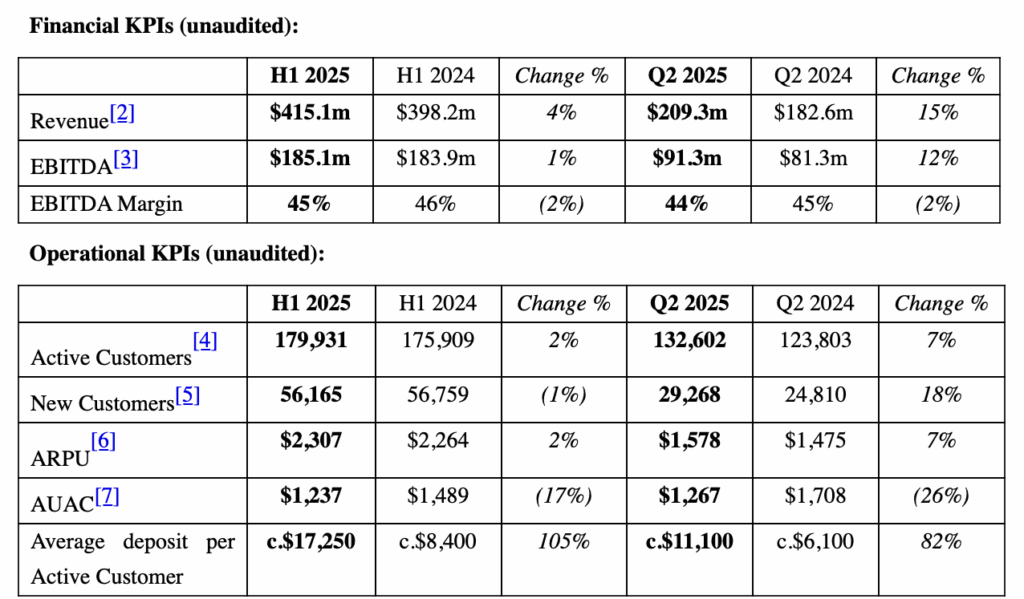

Plus500 delivered strong financial performance in H1 2025, in line with numbers provided in an earlier trading update. Revenue and EBITDA grew year-on-year by 4% and 1%, respectively and in Q2 2025 by 15% and 12%, respectively.

For H1 2025, revenue stood at $415.1m (H1 2024: $398.2m), comprising trading income of $385.5m (H1 2024: $369.1m) and interest income of $29.6m (H1 2024: $29.1m), including revenue of $209.3m in Q2 2025 (Q2 2024: $182.6m).

EBITDA for H1 2025 was $185.1m (H1 2024: $183.9m), equating to an EBITDA margin of 45% (H1 2024: 46%), including $91.3m in Q2 2025 with an EBITDA margin of 44% (Q2 2024: $81.3m and 45%, respectively).

Net profit in H1 2025 was $149.6m (H1 2024: $148.8m) and basic EPS increased by 8% to $2.05 (H1 2024: $1.90).

The Group’s cost base remained highly flexible and responsive to changing market conditions, enabled by its proprietary technology. For H1 2025, 70% of the Group’s costs were variable (H1 2024: 70%), enabling Plus500 to respond quickly and efficiently to a range of different scenarios and customer feedback.

Total SG&A expenses were $232.7m for H1 2025 (H1 2024: $218.0m). The main elements were marketing technology investments of $69.5m (H1 2024: $84.5m), payment processing costs of $21.9m (H1 2024: $19.6m), payroll and related expenses of $32.3m (H1 2024: $25.9m), shared based compensation of $31.3m (H1 2024: $23.9m) and commissions and fees of $33.3m (H1 2024: $22.0m), which can be attributed to the growth of the US futures businesses.

Today, Plus500 has announced additional shareholder returns of $165.0m, comprising share buyback programmes of $90.0m and total dividends of $75.0m. The $90.0m share buyback programme includes an interim buyback programme of $35.0m and a special buyback programme of $55.0m. These programmes will commence following the completion of the current share buyback programme of $110.0m, which was announced and commenced on 18 February 2025.

The $75.0m of dividends includes an interim dividend of $35.0m, representing $0.4925 per share, and a special dividend of $40.0m, representing $0.5628 per share, equating to a total dividend per share of $1.0553. The interim and special dividends have an ex-dividend date of 21 August 2025, a record date of 22 August 2025, and a payment date of 11 November 2025.

Total shareholder returns announced in 2025 amount to $365.0m.

As of 30 June 2025, the Company held in treasury a total of 43,246,147 ordinary shares, which were purchased since the commencement of Plus500’s initial share buyback programmes in 2017, at an average price of £15.72 per share, representing approximately 37.6% of the Company’s issued share capital (the total treasury shares held by the Company comprise the shares purchased less issued treasury shares). Ordinary shares that are repurchased by the Company under its buyback programmes are held in treasury and are not entitled to dividends and have no voting rights.