Plus500 eyes acquisitions, shares down 2% after posting Q4 / FY2020 results

FCA regulated CFDs broker Plus500 released its full year 2020 financial results and 2021 outlook this morning, alongside a new share buyback program, basically extending the buyback effort the company launched last summer.

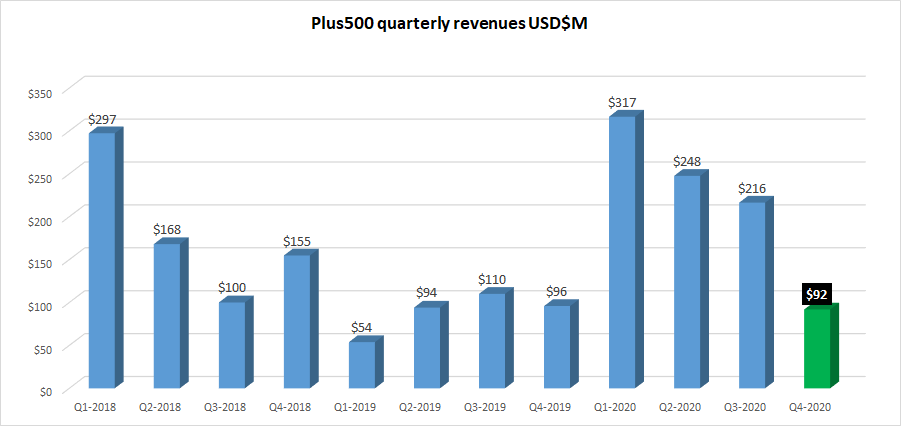

We’d note upfront that the company had already disclosed most of the “big picture” numbers for Q4 and FY2020, in a Trading Update issued at the beginning of January. As we reported at the time, despite healthy customer activity and trading volumes in Q4 Plus500 saw revenue and profit dip precipitously from earlier in the year, due to unhedged market making activity that saw Plus500 customers “win” $109 million in Q4. Plus500 seems to have a policy of doing little hedging of its client book, believing that what it calls “Customer Trading Performance” will be broadly neutral over time.

For Q4 Plus500 revenue came in at $91.9 million – down from $216 million+ in each of the previous three quarters – and EBITDA was $19.9 million. The company’s Q4 EBITDA margin of 22% was well off the 59% margin overall for 2020.

Markets seemed to take Plus500’s announcements in stride, with the company’s shares trading down slightly, by about 2% in early Wednesday trading on the London Stock Exchange. The reaction seems to be mainly to the company’s disclosures that its “new vision and strategy” to access future growth will likely include targeted M&A, and a quick year-to-date 2021 update. In that update, Plus500 stated that usage remains elevated in FY 2021 to date – certainly expected given the rise in retail trading globally the past few weeks – but that its revenues from client trading are again being offset by continued “heightened movements in Customer Trading Performance” – meaning that like in Q4 clients are winning against “the house”, with those gains again going largely unhedged by Plus500.

Regarding new CFD trading rules about to be implemented in Australia, Plus500 noted that the Board continues to assess the potential impact of the impending introduction of the new ASIC regulations, but believes that such impact is already incorporated in current compiled analysts’ consensus forecasts for Plus500.

The good news, longer term, for Plus500 is that its user acquisition costs remain low, well below traditional revenue-per-client levels. The company’s AUAC, or average user acquisition cost, was $916 in Q4 and $750 overall for 2020., and that despite record numbers of new clients signups throughout the year.

Some financial highlights for Plus500 include:

|

|

FY 2020 |

FY 2019 |

Change |

Q4 2020 |

Q4 2019 |

Change |

|

Revenue |

$872.5m |

$354.5m |

146% |

$91.9m |

$95.9m |

(4%) |

|

EBITDA |

$515.9m |

$192.3m |

168% |

$19.9m |

$56.6m |

(65%) |

|

EBITDA Margin % |

59% |

54% |

9% |

22% |

59% |

(63%) |

|

Cash balance at period end |

$593.9m |

$292.9m |

103% |

$593.9m |

$292.9m |

103% |

Operational Highlights:

|

|

FY 2020 |

FY 2019 |

Change |

Q4 2020 |

Q4 2019 |

Change |

|

Number of Active Customers |

434,296 |

199,720 |

117% |

215,305 |

99,247 |

117% |

|

Number of New Customers |

294,728 |

91,388 |

223% |

50,314 |

19,489 |

158% |

|

ARPU |

$2,009 |

$1,775 |

13% |

$427 |

$966 |

(56%) |

|

AUAC |

$750 |

$1,046 |

(28%) |

$916 |

$1,124 |

(19%) |

David Zruia, Chief Executive Officer, commented:

David Zruia, Chief Executive Officer, commented:

“2020 was an exceptional year for Plus500, in unprecedented market conditions, where we delivered a record performance due to the strength and agility of our technology and its ability to respond rapidly to market developments and news events. Our performance was supported by the commitment of our people who, in challenging circumstances, given the COVID-19 pandemic, ensured that our customers received a consistently high quality experience.

“Our vision is to enable simplified, universal access to financial markets, as we start to evolve from a technology company solely focused on CFDs to a multi-asset fintech group over time. We aim to achieve this by accessing multiple growth opportunities, through organic investment in our technology and targeted M&A. Specifically, we aim to expand our CFD offering geographically, launch new trading products, introduce new financial products and deepen our engagement with customers to achieve growth in the coming years.

“In addition, we will continue to invest in our business, with approximately $50m to be incrementally invested in R&D over the next three years, designated to develop new products and services, drive innovation and scale our technology, including the establishment of a new R&D centre in Israel.

“Plus500 continues to operate in accordance with the applicable laws, global regulatory standards and industry best practices, and we remain very well placed to accommodate future regulatory changes, as and when they are implemented.

“In an unprecedented market environment, where circumstances can develop very quickly, the strength of our technology ensures we remain very well prepared for future growth and, consequently, the Board remains confident about the outlook for Plus500.”

Plus500’s full release on Q4 and FY2020 results can be seen here.