NAGA Group shares up 6% on volume update, analyst coverage

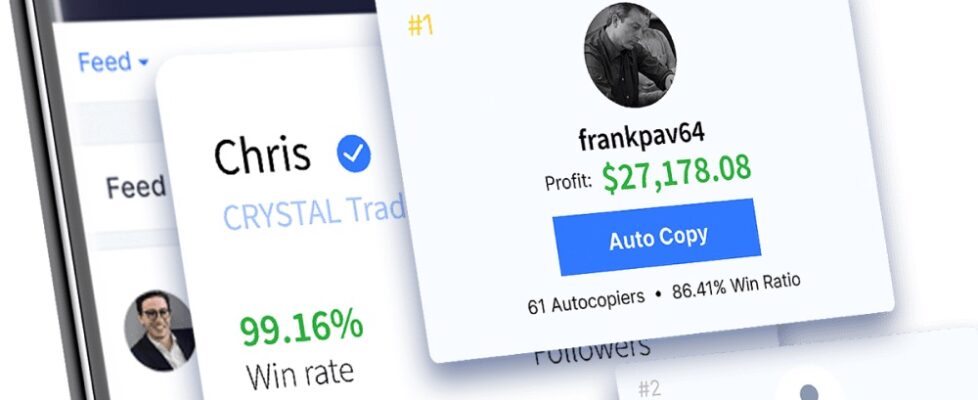

Shares of social trading focused Retail FX brokerage firm NAGA Group AG (FRA:N4G) traded up by more than 6% today, after the company gave a fairly rosy update for the fourth quarter of 2020, and also announced that analysts from Hauck & Aufhäuser Research have started coverage of the company with a “buy” recommendation.

NAGA noted that trading volume is ongoing in Q4 at a record level, after the company reported record results in Q3. The company saw a new record of transactions in November, and also launched the NAGA Pay payments app with millions in transaction volume.

Hamburg based NAGA said that the number of real money transactions is at a record level so far in Q4, with a total of 1.3 million transactions and new monthly records in October with 645,000 and November with 680,000. NAGA therefore expects that the full Q4 figure will clearly surpass the company’s record of Q3 2020 (1.5 million transactions). At the same time, trading volume in the fourth quarter has already exceeded €25 billion (Q3 2020: €33 billion) and will therefore also reach a record level.

NAGA Group CEO Benjamin Bilski summarized:

NAGA Group CEO Benjamin Bilski summarized:

“We are fully on track to achieve our annual targets. We are pleased that our investments in Marketing & Sales are bearing fruits and that we can continue to expand and improve our customer base, customer activity and the entire platform. NAGA has found a growth formula that enables it to grow in a precise way, fully, digitally and on a global level. The market potential is promising and the industry is growing – especially due to accelerated digitization, the topic of investing is more popular than ever.”

As noted above, NAGA also announced that analysts from Hauck & Aufhäuser Research have started coverage of the company’s shares with a buy recommendation and a price target of €5.90 (NAGA is now at €3.44). In its initial study, Hauck & Aufhäuser highlights the successful global rollout and digital marketing strategy and underlines the unique symbiosis of a trading and social media platform, which should lead to high YoY sales growth in the coming years and an increasing EBITDA margin.

Bilski commented on the initial coverage:

“We are delighted that Hauck & Aufhäuser Research started covering our share. It is one of the most renowned sources of information at hand which provides as objective as possible an assessment of our growth potential. The FinTech market is growing rapidly and the NAGA GROUP has all the characteristics to grow with it. It also confirms that we want to increase the transparency of our company and deal more intensively with investor relations. We are pleased that we can point out the future opportunities of the NAGA GROUP to other private and institutional investors on a wider scale.”

NAGA also reported on the launch of the neo banking app NAGA Pay. The mobile digital bank and the card program recorded over 6,000 users and over €2.5 million in transaction volume in the first 21 days after launch. The app offers users a free IBAN account as well as a Mastercard and a crypto wallet using fully digital onboarding. Before year-end the company plans to released a stock trading feature within the app. At the beginning of 2021 NAGA said it will officially start the promotion of the app.