Interactive Brokers reports rise in revenues for Q2 2025

Electronic trading major Interactive Brokers Group, Inc. (NASDAQ:IBKR) has announced its financial results for the quarter ended June 30, 2025.

Reported and adjusted diluted earnings per share were both $0.51 for the second quarter of 2025. For the year-ago quarter, reported diluted earnings per share2 were $0.41 and $0.44 as adjusted.

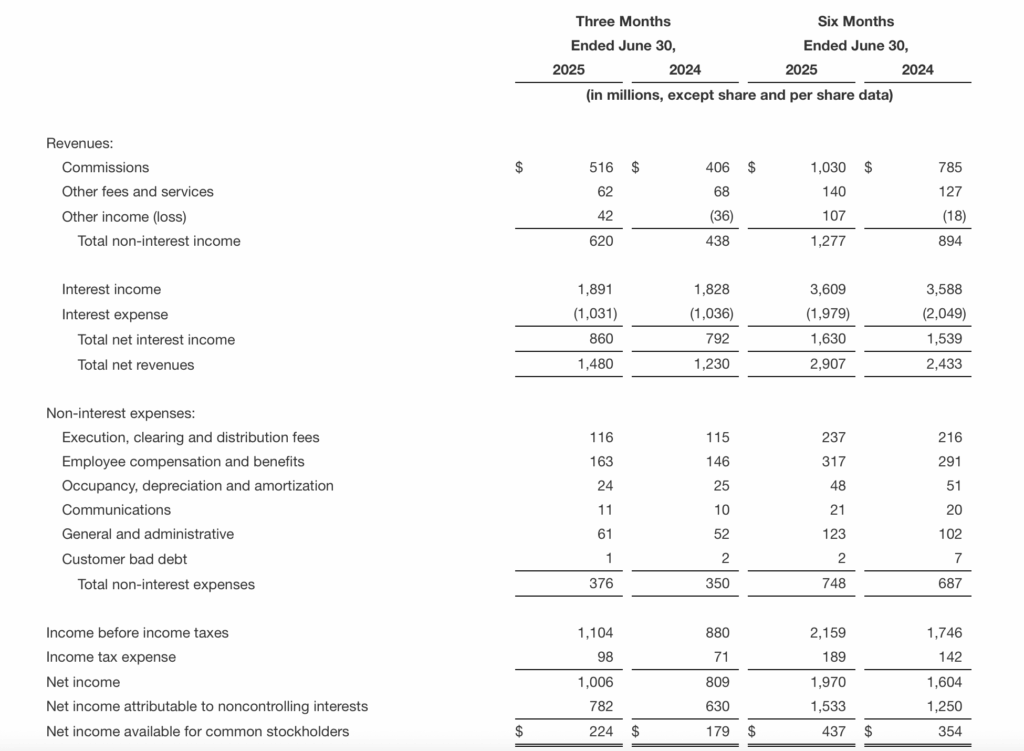

Reported and adjusted net revenues were both $1,480 million for the second quarter of 2025. For the year-ago quarter, reported net revenues were $1,230 million and $1,290 million as adjusted.

Reported and adjusted income before income taxes were both $1,104 million for the second quarter of 2025. For the year-ago quarter, reported income before income taxes was $880 million and $940 million as adjusted.

Commission revenue increased 27% to 516 million on higher customer trading volumes. Customer trading volume in stocks, options and futures increased 31%, 24% and 18%, respectively.

Net interest income increased 9% to $860 million on higher average customer credit balances and securities lending activity. Net interest income includes an approximately $26 million one-time credit related to recovery of taxes withheld at source.

Other fees and services decreased 9% to $62 million, led by a decrease of $7 million in risk exposure fees, which was partially offset by a $2 million increase in FDIC sweep fees.

Execution, clearing and distribution fees increased 1% to $116 million, driven by a new FINRA Consolidated Audit Trail (“CAT”) fee initiated during the fourth quarter of 2024 and higher customer trading volumes in stocks, options and futures, mostly offset by greater capture of liquidity rebates from certain exchanges.

General and administrative expenses increased 17% to $61 million, driven primarily by an increase of $8 million in advertising expenses.

Pretax profit margin for the second quarter of 2025 was 75% both as reported and as adjusted. For the year-ago quarter, pretax margin was 72% as reported and 73% as adjusted.

The Interactive Brokers Group, Inc. Board of Directors declared a quarterly cash dividend of $0.08 per share. This dividend is payable on September 12, 2025, to shareholders of record as of September 1, 2025.

- Customer accounts increased 32% year-on-year to 3.87 million.

- Customer equity increased 34% to $664.6 billion.

- Total DARTs increased 49% to 3.55 million.

- Customer credits increased 34% to $143.7 billion.

- Customer margin loans increased 18% to $65.1 billion.

Other income increased $78 million to a gain of $42 million. This gain mainly comprised (1) the non-recurrence of a loss of approximately $48 million on positions taken over as a customer accommodation due to a technical issue at the New York Stock Exchange that occurred on the morning of June 3, 2024; (2) $17 million related to our principal trading and investing activities; and (3) $15 million related to IBKR currency diversification strategy.