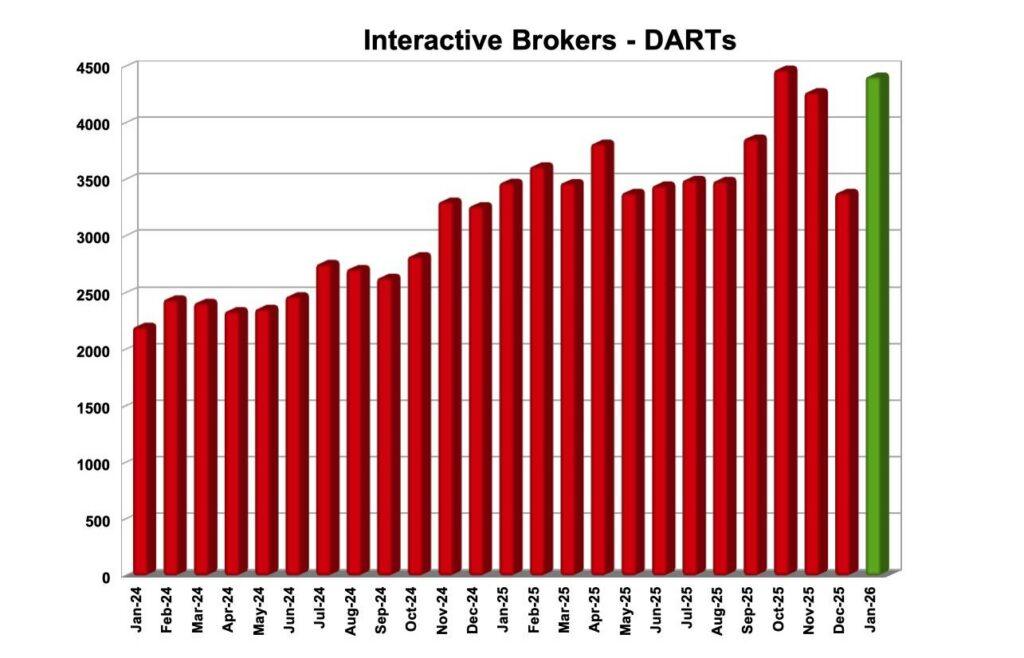

Interactive Brokers registers 27% Y/Y increase in DARTs in January 2026

Electronic trading major Interactive Brokers Group, Inc. (NASDAQ:IBKR) has just posted its key operating metrics for January 2026.

The company registered 4.411 million Daily Average Revenue Trades (DARTs) in January 2026, 27% higher than in January 2025 and 30% higher than in December 2025.

Ending client equity amounted to $814.3 billion, 38% higher than prior year and 4% higher than prior month. Ending client margin loan balances reached $91.2 billion, 41% higher than prior year and 1% higher than prior month.

The number of client accounts was 4.539 million, 32% higher than in January 2025 and 3% higher than in December 2025.

The average commission per cleared Commissionable Order of $2.62 including exchange, clearing and regulatory fees.

Speaking of Interactive Brokers’ performance, let’s note that the company has recently reported its financial results for the final quarter of 2025.

Reported diluted earnings per share were $0.63 for the quarter to end-December 2025 and $0.65 as adjusted. Reported net revenues were $1.64 billion for the fourth quarter of 2025 and $1.67 billion as adjusted.

Commission revenue increased 22% to $582 million on the back of higher customer trading volumes. Customer trading volume in options, futures and stocks increased 27%, 22% and 16%, respectively.

Reported income before income taxes was $1.30 billion for the final quarter of 2025 and $1.33 billion as adjusted.

Net interest income increased 20% to $966 million thanks to higher average customer margin loans and customer credit balances and stronger securities lending activity.