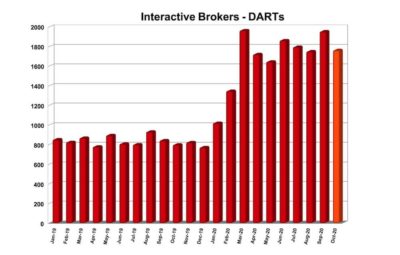

Interactive Brokers marks 10% M/M drop in daily average revenue trades in October 2020

Electronic trading major Interactive Brokers Group, Inc. (NASDAQ:IBKR) today posted its key operating metrics for October 2020, with daily average revenue trades (DARTs) up from a year earlier but down from the level registered in September 2020.

- Interactive Brokers registered 1,762,000 DARTs in October 2020, 121% higher than a year earlier and 10% lower than prior month.

- Ending client equity amounted to $232.6 billion, 43% higher than prior year and about even with prior month.

- Ending client margin loan balances totalled $31.7 billion, 25% higher than prior year and 6% higher than prior month.

- Ending client credit balances reached $71.5 billion, including $2.9 billion in insured bank deposit sweeps, 26% higher than prior year and 1% higher than prior month.

- The number of client accounts amounted to 1,008,000, up 50% from the level seen a year ago and 3% higher than prior month.

- Average commission per cleared Commissionable Order was $2.49 including exchange, clearing and regulatory fees.

Let’s note that Interactive Brokers registered net revenues of $548 million and income before income taxes of $334 million in the third quarter of 2020, compared to net revenues of $466 million and income before income taxes of $281 million for the same period in 2019.

Adjusted net revenues were $518 million and adjusted income before income taxes was $304 million in the third quarter of 2020, compared to adjusted net revenues of $525 million and adjusted income before income taxes of $340 million for the same period in 2019.