IG Group posts rise in revenues in Q3 FY23 YTD

Electronic trading major IG Group Holdings plc (LON:IGG) today issued its revenue update for the three months to 28 February 2023 (“Q3 FY23”).

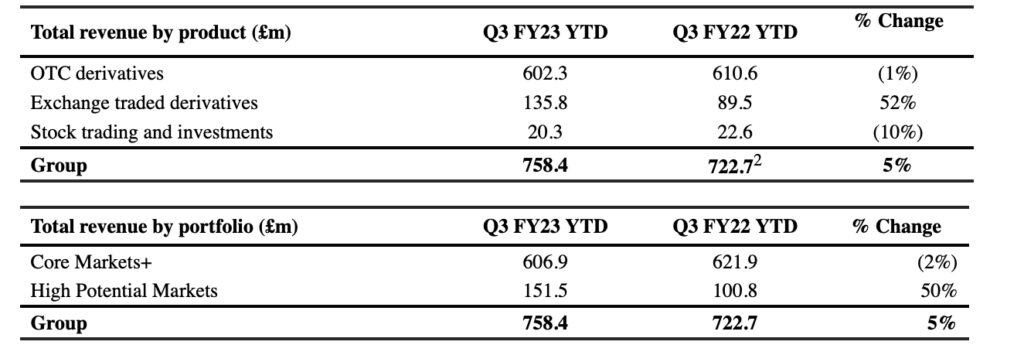

Year-to-date total revenue from continuing operations was £758.4 million, up 5% (Q3 FY22 YTD: £722.7 million). Active client numbers for Q3 YTD were 335,400, down 5% on prior year, reflecting quieter market conditions in the quarter.

Interest income was an important driver of revenue growth in the period. US interest income was £32.7 million for Q3 YTD (Q3 FY22 YTD: £0.6 million), and non-US interest income was £17.4 million (Q3 FY22 YTD: (£1.2) million). The Group maintained the level of client money balances during the period.

Q3 FY23 YTD revenue in the Core Markets+ was £606.9 million (Q3 FY22 YTD: £621.9 million), down 2% due to OTC active clients and revenue per client being down marginally versus the prior period.

Q3 FY23 YTD revenue in the High Potential Markets was £151.5 million, up 50%, or 38% on a pro forma basis. Revenue per client increased significantly across all businesses in the portfolio, partially offset by a reduction in the number of active clients.

Tastytrade total revenue for Q3 FY23 YTD was £122.8 million up 50% (Q3 FY22 YTD: £81.8 million) or 36% on a pro forma basis. On a USD pro forma basis, tastytrade revenue was up 19%, with the benefit of interest income offsetting a softer trading revenue performance.

On a year-to-date basis, IG’s non-OTC businesses constituted 21% of Group total revenue with its US businesses accounting for 18% of its total revenue.

Core Markets+ total revenue in Q3 FY23 was £182.6 million (Q3 FY22: £221.6 million), reflecting the lower OTC derivatives revenue in the period against a challenging comparative period.

High Potential Markets total revenue in Q3 FY23 was £56.7 million, up significantly on Q3 FY22, reflecting strong growth across IG’s US businesses as well as European ETD business, and highlighting the growth prospects of this set of businesses.

As part of the new capital allocation framework, in July 2022 the Group announced a £150 million share buyback programme, which was extended by £50 million in January 2023, to a total of £200 million. As at 13 March, approximately 17.4 million shares have been re-purchased, at a cost of £137.4 million.

IG expects FY23 revenue and profit before tax to be in line with current market expectations. Its medium-term revenue and profit margin guidance remains unchanged.