GKFX posts £9 million 2019 loss in transition from Retail FX

FCA regulated FX and CFDs broker GKFX Financial Services Limited has reported its 2019 financials indicating a sharp drop in revenues and a nearly £9 million annual loss.

GKFX revenues for 2019 came in at £3.63 million, down 59% from the previous year’s £8.86 million, as the company surrendered its FCA Retail permissions to focus entirely on Professional and Wholesale clients. The company’s net loss of £8.96 million was actually smaller than the £9.42 million loss posted in 2018.

The company said that despite this change in clients, the principal activity of the group remains unchanged and therefore the directors are of the opinion that all activities are considered to be continuing. During the first half of the year the retail trade was transferred to AKFX Financial Services Ltd, based and regulated in Malta. AKFX is a related party to GKFX by virtue of common ownership.

The GKFX group is controlled by Turkish businessman Kasim Garipoglu.

The company’s MiFID Branches in Spain and Germany ceased offering regulated services in 2019, and its representative office in Dubai ceased regulatory activities.

The company has also re-branded from GKFX to GKPro to better reflect its new target market. The GKFX brand, as noted above, is now operated by the Malta-based AKFX.

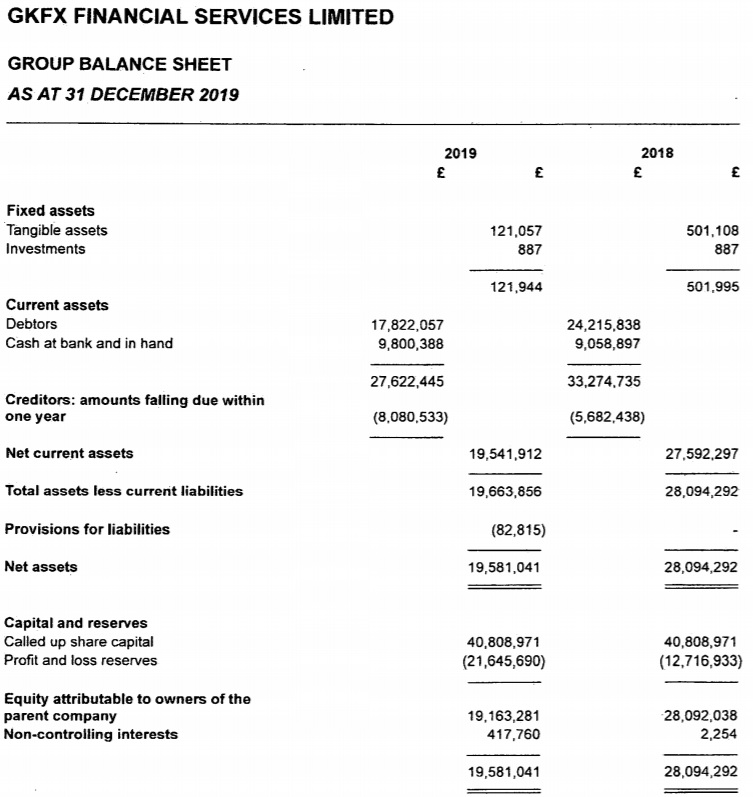

Despite the continued losses GKFX reported that it remains well capitalized. As of 31st December 2019, the firm’s regulatory capital resources comprise issued capital less reserves and totaled £19,444,094 (2018 – £28,092,038).

The change in strategy also brought with it a change in management for GKFX. The company brought on board former Admiral Markets, Pepperstone UK, and GMI UK executive Iain Rogers as its Executive Director in mid 2019. Mr. Rogers replaced Rob Woolfe, who left GKFX to now head London Capital Group.

GKFX’s 2019 income statement and balance sheet follow: