FX week in review: Saxo Bank acquires, eToro hits unicorn status

Which Swiss online broker did Saxo Bank acquire, significantly increasing its presence in Switzerland?

What led eToro to be conferred unofficial “unicorn” status?

Why were payment verification firm iSignthis and its CEO John Karantzis sued by ASIC?

Which two executives joined FXSpotStream?

Answers to these questions and a whole lot more appeared first or exclusively this week on FNG. Some of the top forex industry news items to appear on FNG this week included:

Exclusive: Saxo Bank expands in Switzerland buying Strateo. FNG Exclusive… It looks like the Swiss online trading market is heating up. After we exclusively reported about the launch of FlowBank by former LCG CEO Charles-Henri Sabet this summer, another well known name is expanding its footprint in the Swiss forex space. FNG has learned that Saxo Bank (Suisse) SA, the Switzerland subsidiary of Copenhagen based Retail FX broker Saxo Bank, has signed an agreement to acquire Strateo’s online trading activity. As part of the transaction, Saxo Bank will take over Strateo’s customer relations in Switzerland and integrate them into its organization. In doing so, Saxo Bank is apparently taking a decisive step in the implementation of its growth strategy in the Swiss market.

Exclusive: Saxo Bank expands in Switzerland buying Strateo. FNG Exclusive… It looks like the Swiss online trading market is heating up. After we exclusively reported about the launch of FlowBank by former LCG CEO Charles-Henri Sabet this summer, another well known name is expanding its footprint in the Swiss forex space. FNG has learned that Saxo Bank (Suisse) SA, the Switzerland subsidiary of Copenhagen based Retail FX broker Saxo Bank, has signed an agreement to acquire Strateo’s online trading activity. As part of the transaction, Saxo Bank will take over Strateo’s customer relations in Switzerland and integrate them into its organization. In doing so, Saxo Bank is apparently taking a decisive step in the implementation of its growth strategy in the Swiss market.

eToro shares change hands at $2.5 billion valuation. Welcome to the world of Retail FX unicorns. Israeli business news website Calcalist is reporting that Retail FX and CFDs broker eToro has seen its valuation soar in the secondary private share market, as an unnamed US institutional investor acquired a $50 million block of eToro shares from a selling shareholder at a company valuation of about $2.5 billion. eToro already had attained near-unicorn status, with its latest funding round in early 2018 which saw China Minsheng Financial lead a $100 million round at an $800 million valuation. This of course means that investors in that round have seen their investment value triple in under less than three years.

eToro shares change hands at $2.5 billion valuation. Welcome to the world of Retail FX unicorns. Israeli business news website Calcalist is reporting that Retail FX and CFDs broker eToro has seen its valuation soar in the secondary private share market, as an unnamed US institutional investor acquired a $50 million block of eToro shares from a selling shareholder at a company valuation of about $2.5 billion. eToro already had attained near-unicorn status, with its latest funding round in early 2018 which saw China Minsheng Financial lead a $100 million round at an $800 million valuation. This of course means that investors in that round have seen their investment value triple in under less than three years.

iSignthis and CEO John Karantzis sued by ASIC over Revenue and Visa disclosures. Australia’s financial regulator ASIC has announced that it has commenced civil penalty proceedings in the Federal Court against RegTech solutions provider iSignthis Ltd and its managing director and chief executive officer Nickolas John Karantzis. iSignthis (ASX:ISX) is publicly traded, but its shares have been halted for more than a year by the ASX, after the exchange operator questioned iSignthis’ disclosures. The company has unsuccessfully sued the ASX to have its shares unfrozen. iSignthis provides automated payment verification and payment services to financial services clients, including numerous Retail FX sector firms, to help them meet KYC requirements under anti-money laundering regulations in different jurisdictions.

iSignthis and CEO John Karantzis sued by ASIC over Revenue and Visa disclosures. Australia’s financial regulator ASIC has announced that it has commenced civil penalty proceedings in the Federal Court against RegTech solutions provider iSignthis Ltd and its managing director and chief executive officer Nickolas John Karantzis. iSignthis (ASX:ISX) is publicly traded, but its shares have been halted for more than a year by the ASX, after the exchange operator questioned iSignthis’ disclosures. The company has unsuccessfully sued the ASX to have its shares unfrozen. iSignthis provides automated payment verification and payment services to financial services clients, including numerous Retail FX sector firms, to help them meet KYC requirements under anti-money laundering regulations in different jurisdictions.

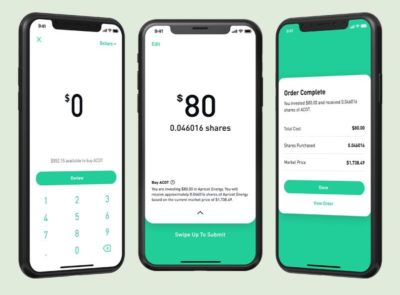

Robinhood looking at $20B Q1-2021 IPO led by Goldman. Online trading upstart Robinhood has taken another step in preparation for a planned early 2021 IPO. Reuters is reporting that Goldman Sachs has been selected to lead the Robinhood IPO, after the company held a brief “beauty contest” among leading US and international investment banks. The company has also apparently contemplated going public via the merger-with-a-SPAC route, a method recently selected by payment platform company Paysafe, but will look go the more traditional route itself. The target valuation for the IPO will be $20 billion, but of course a lot can still happen between now and when the IPO gets to market next year.

Robinhood looking at $20B Q1-2021 IPO led by Goldman. Online trading upstart Robinhood has taken another step in preparation for a planned early 2021 IPO. Reuters is reporting that Goldman Sachs has been selected to lead the Robinhood IPO, after the company held a brief “beauty contest” among leading US and international investment banks. The company has also apparently contemplated going public via the merger-with-a-SPAC route, a method recently selected by payment platform company Paysafe, but will look go the more traditional route itself. The target valuation for the IPO will be $20 billion, but of course a lot can still happen between now and when the IPO gets to market next year.

FX industry executive moves reported this week at FNG include:

❑ Exclusive: VantageFX adds easyMarkets’ Gabriela Noriega for LATAM coverage.

❑ Exclusive: FXSpotStream adds Caryn Kim as Bus Dev Manager.

❑ Erik Nordahl joins Christian Frahm’s United Fintech.

❑ FXSpotStream hires FXall and Traiana alum Merg Limani.

❑ Shirley Garrood to step down from Hargreaves Lansdown’s Board.

❑ Graham Ferguson to step down as First Derivatives’ CFO.

❑ Jefferies grants $12.5M in equity awards to CEO and President.