FCA survey shows proportion of profitable investment management firms rising

The UK Financial Conduct Authority (FCA) today published the results of its coronavirus (Covid-19) financial resilience surveys. The surveys were sent to solo-regulated firms to inform the FCA of the impact of coronavirus on firms’ financial resilience.

The survey results show that between February (pre-lockdown) and May/June (during the impact of the first lockdown), firms across the sectors experienced significant change in their total amount of liquidity. This was defined as cash, committed facilities and other high-quality liquid assets.

Three sectors saw an increase in liquidity between the 2 reporting periods: Retail Investments (8%), Retail Lending (8%) and Wholesale Financial Markets (83%), the latter seeing the greatest increase. The other 3 sectors saw a decrease in available liquidity: Insurance Intermediaries & Brokers (30%), Payments & E-Money (11%) and Investment Management (2%).

Let’s note that the Investment Management sector is of particular interest to us, as it covers asset management, benchmarks, alternatives, custody services and contracts for difference (CFD) providers.

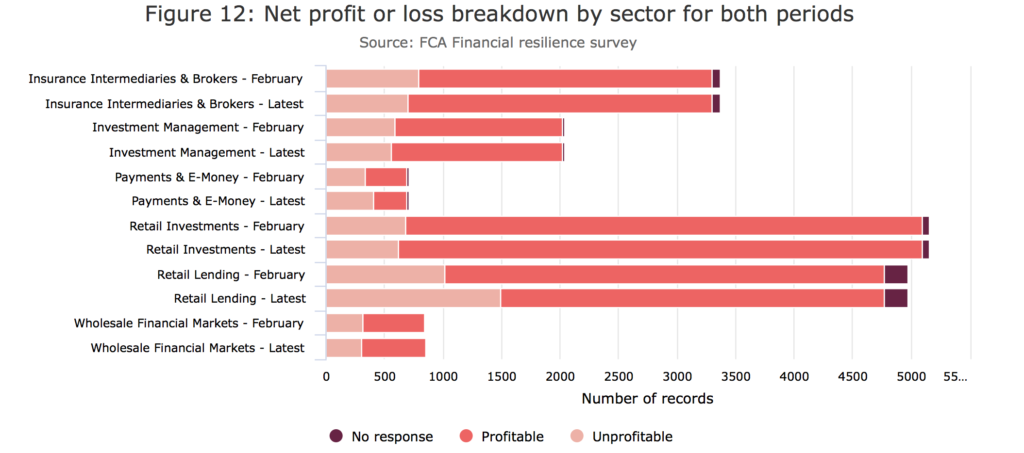

The Payments & E-money sector has the lowest proportion of profitable firms, followed by Wholesale Financial Markets, Investment Management, Insurance Intermediaries & Brokers, Retail Lending and Retail Investments. For the firms that responded to this question the greatest decrease in profitable firms between February and May/June was seen in the Retail Lending sector (10 percentage points) followed by Payments & E-Money (9 percentage points).

The other 4 sectors saw a small increase in profitable firms between February and May/June as follows: Insurance Intermediaries & Brokers (2 percentage points), Investment Management (2 percentage points), Wholesale Financial Markets (2 percentage points) and Retail Investments (1 percentage point).

When asked whether they expected coronavirus to have a negative impact on their net income, 59% of respondents had said that they did. Of these, 72% expected the impact to be between 1% and 25%. 3% expected the impact to be 76%+ within the next 3 months of the survey being taken.

Overall, the sector with the least negative outlook was Investment Management, with 73% of firms expecting a positive or neutral impact from coronavirus on their business model and 27% expecting a negative impact.