Exclusive: Valutrades shareholders inject £1.6M in new capital

FNG Exclusive… FNG has learned that London based Retail FX and CFDs broker Valutrades has raised £1.6 million (USD $2.1 million) in fresh capital from its controlling shareholders, Indonesian investors Aman Lakhiani and Anil Bahirwani.

Anil Bahirwani is the founder and CEO of investment firm AMB Group Indonesia. He previously founded MIFX, which grew to be Indonesia’s largest Retail FX broker. In 2007 he established Surya Anugrah Mulya, one of the region’s most prominent FX liquidity providers. Mr. Bahirwani took over control of FCA regulated Valutrades in 2016, and installed Surya Anugrah Mulya’s Senior Vice President of Operations, Graeme Watkins, as CEO of Valutrades, an office he has held since then.

We reported last month that Valutrades hit something of a rough patch in 2023, with the company seeing Revenues down by 77% leading to a £3.8 million loss in 2023. The company’s Net Assets (i.e. Shareholders Equity) fell from £4.7 million in 2022 to £1.7 million as at year-end 2023, so the current capital injection will help shore up the company’s equity base.

FNG spoke with Valutrades CEO Graeme Watkins, who commented,

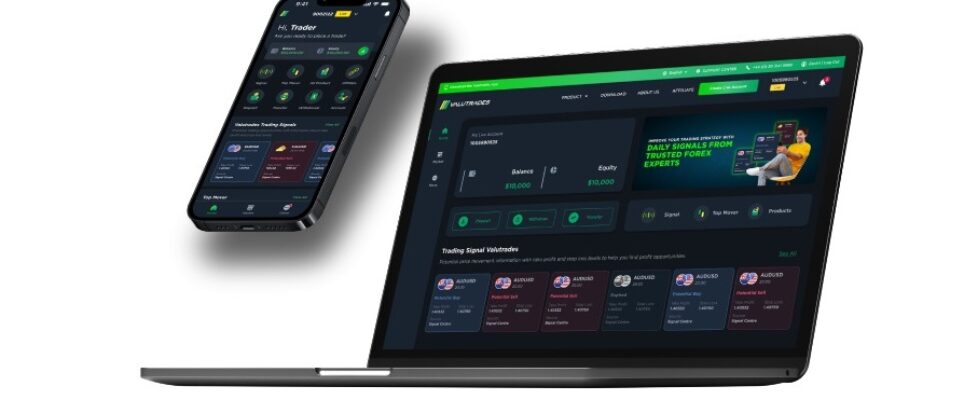

“The latest capital injection shows our shareholders continued support for the business and our long term growth strategy. The latest capital injection ensures we retain a strong capital base and will be used to expand into new markets now our rebranding and upgraded tech stack are complete.”

This actually marks the third capital raise by Valutrades over the past 12 months. We reported exclusively late last year that the company’s shareholders were putting in $1 million in fresh capital, to help support a planned Valutrades rebrand. The shareholders put an additional £1 million into the company in March 2024.