Exclusive: Admiral Markets’ Jens Chrzanowski on record 1H-2020 results

Estonia based Retail FX and CFDs brokerage group Admiral Markets released its first half 2020 results today, indicating record revenues and profits for the company – and more than double last year’s top-line results.

While we reproduce the company’s full results release below, we were equally interested in:

How has the company managed through the Covid-19 crisis?

How are ‘neo brokers’ such as Robinhood affecting the Forex and CFD trading industry?

What does company management see for Admiral Markets and the FX industry moving forward?

So, we’re pleased to present our conversation on 1H-2020 results and a whole lot more with Admiral Markets’ Member of the Management Board and Co-CEO Jens Chrzanowski.

Here is what Jens had to say:

FNG: Hi Jens, and thanks for joining us today. Please give us an overview how the first half of 2020 went for Admiral Markets.

Jens: For Admiral Markets, the first half of 2020 was the most successful in its entire history. We are extremely proud to present all-time highs in net trading revenue and many other KPIs, since our founding 2001. The net trading revenue of Admiral Markets AS reached 31,6 million Euro and from Admiral Markets Group AS, its parent company, the net trading revenue reached 37,9 million Euros.

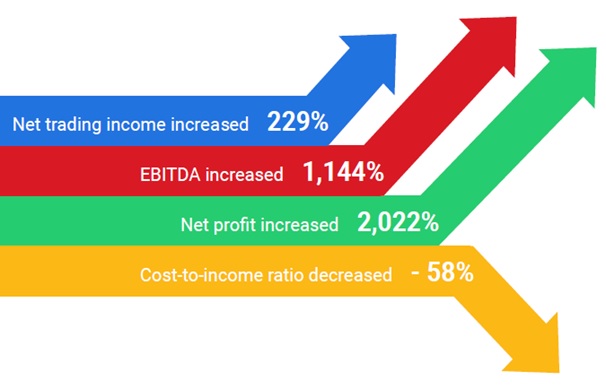

For Admiral Markets AS, this means an increase of 229% and a decrease in Cost-to-Income ratio of 58%.

Several months saw our core products, DAX30 and DJI30 CFD, double in their trading volume compared to the year before.

And this was all achieved during the global lockdown, when we were working in home offices across all our regions, as our main concern was to keep our team members and their close ones safe. We maintained social distance, but still managed to stay together while offering the quality we are known for in the market, delivering our high-end trading and investing experience to our clients.

Despite the state of emergency which affected everyone around the globe, we achieved many important IT milestones which played a crucial role in our results.

We upgraded MetaTrader Supreme, our Special Edition package for MT4 & MT5 with two new free features, and in January we introduced a new Wallet for better account management. We also added PayPal to our free, instant deposit options for Admiral Markets UK and established Gold for passive investors as an account currency to hold capital in Gold without leverage. Following the WTI oil event, during which, for the first time in history, the Future showed a negative price, we introduced a new Future based Oil CFD with zero Swaps and no overnight costs. So, it was a very, very active time – and we are happy to already see the great results now. We are extremely thankful to our amazing team, who displayed incredible team spirit and dedication.

FNG: How has Admiral Markets adapted in managing its operations during the Covid-19 pandemic? Are people fully or partly on work-from-home mode? How has the transition been?

Jens: Since our founding, we have always been an online company. We were able to seamlessly switch our global staff to the “new normal”, working from home, in just one or two days, across all our regional offices.

Our whole global communication is designed to function remotely with the highest security measures. Internal messenger, a ticket system, Intranet and more, we were long used to such tools in our regional offices, and during the state of emergency, our experience allowed us to seamlessly work from home. We even got a special award, recognizing this, presented by the German DKI: “Stable Partner in Times of Crisis” in the CFD Broker segment, as many other brokers failed to deliver in the peak of the COVID19 crisis. They simply were not prepared to handle the inbound client communication while working from home, or their systems were not prepared for the change in office locations. We are very proud and thankful to our team that we were able to prove, once again: quality matters. The importance of having the right broker beside you is the lesson learned during the crisis. The grass is always greener on our side.

Since July, we have been transitioning more and more of our people to back to our offices, but we are doing this in stages. Our employees can still work from home today, but we encourage them to pursue some occasional office days in order to meet each other and attend the meetings. We have established many precautions in all our offices: maintaining distance, disinfectant stations at the entrances, and a number of other measures which help us to get used to the “new normal” we now live in. In the long run, we believe that working from home will be more usual than before, so taking advantage of time between the home and the office is one of the few positive aspects from COVID19.

FNG: Long term, how do you think that the experience of the Covid-19 crisis will affect FX traders and the FX industry?

Jens: I must point out that most of the volatility during the Covid-19 crisis did not happen in the Forex Markets. Our clients were focused more on trading the highly active global indices, primarily the DAX and Dow Jones. Also, we don’t see ourselves simply as a Forex Broker anymore, we offer Forex & CFD trading of course, but also classic stocks without any leverage. Being only a Forex Broker leaves you vulnerable to the lower volatility of some currencies. By offering a wide range of products – Admiral Markets offers more than 8.000 trading instruments – so traders will always find interesting possibilities and markets.

These days, people are discussing whether, following COVID-19, the global economies will make a recovery in a U-, V-, or W-shape on the financial stock markets. The German DAX, for example, is seeing a V-formation developing! This translates to huge movements in the market. And it doesn’t impact us if the markets move up or down – our clients can trade both directions, Long & Short, up or down. Gold is also at an all-time high, and very interesting to trade, the same can be said of Tesla and other high-flyers. Do not limit yourself to just Forex, as we tell all our clients, you have many more chances to trade, with or without leverage, and again: up and down.

FNG: Do you see these favorable conditions continuing for Admiral Markets, and for Forex brokers in general, for the rest of 2020?

Jens: We see a boost of demand and trading for all types of brokers, whether classic stockbrokers, the new so-called ‘neo brokers’ such as Robinhood, and also the Forex & CFD brokers. We like that these ‘neo brokers’ bring a lot of attention to the markets for a wider range of people, and if people know trading, they also know of us. Our conditions remain the same: ZERO for most of our global stock CFDs. And if clients of such brokers trade smaller volumes, stock CFDs, in particular, could be interesting for them. Smaller, easier to manage leverage of up to just 1:5, and again: both directions, up and down. Classic stock trading, as well, often means making a profit only in one direction, and at all-time-highs, it could be relevant to calculate with a down-trend in mind, too.

For the major global economies, the full impact of the global COVID disaster arrives with a delay. Just yesterday (30th July), we heard of the US economy and its sharpest contraction since World War Two, down by 32.9% from this time last year. Germany’s economic output, which functions as an indicator for Europe, fell by over 10% this quarter— also just published yesterday. The financial markets rapidly went up during the last 3 months, because the billions, and trillions, of Dollars and Euros coming from governments and central banks. All of this rapid influx of liquidity for the stimulation and a hard-hit economy will lead to one thing in particular: volatility! And this is what active traders, our typical clients, are waiting for.

FNG: What else can we expect to hear from Admiral Markets in the coming months?

Jens: We just launched our new trading app, developed fully in-house. On our way to becoming a financial hub for a variety of trading, investing, social trading and financial added value services, this app will be the ultimate mobile application that our clients need to trade on-the-go. It provides access to our extensive product offering: Forex, CFDs on stocks, indices, commodities, cryptocurrencies, and ETFs. The app has a user-friendly interface, which allows users to trade on mobile devices at any time, any place, opening up a more personal and simpler trading experience than ever.

We also entered the podcast world, so analytics and educational content produced by Admiral Markets can also available via Spotify, Google Podcast, and Apple Podcast, and all other podcast platforms.

In general, we are hard at work upgrading our brand. Our product offering and level of quality is already one of the best, but brand awareness could still go up.

To be also more visible within Estonia, where our global group head office is headquartered, we are now occupying the Admiral Markets branded gate 5 of the Tallinn Lennart Meri Airport.

In our core market of Germany, our educational webinar & video services are the leading the industry, as no other German broker channel has as many subscribers as ours! We see ourselves as the market leader in quality for Germany, where we have been granted the most prestigious client awards, including several naming us CFD Broker of the year or Best CFD Broker.

Quantity follows Quality, and everybody needs to know it. We are going forward!

Admiral Markets

Half Year financial report

Admiral Markets AS 2020 Unaudited 6 Months Financial Results

Admiral Markets AS made a record-breaking revenue and profits in the first half of 2020

For Admiral Markets AS, the first half of 2020 was the most successful in its entire history. The company made a record-breaking revenue and profit in 19 years. In the first half of 2020, the net trading income of Admiral Markets AS increased to 31.6 million euros. The corresponding figure of Admiral Markets Group AS, the parent company of Admiral Markets AS, was 37.9 million euros. The net profit of Admiral Markets AS increased by 2022%, compared to the first half of 2019 and the net profit of Admiral Markets Group AS by 1321%.

Sergei Bogatenkov, the CEO of Admiral Markets, said that despite the global state of emergency caused by COVID19, which defined the first half of the year, they were able to be flexible and react quickly as a company, switching the headquarters in Tallinn as well as other regional offices to home office mode only in a couple of days.

“The most important thing was to ensure a safe environment for our people. As our business is conducted in the online world, we were able to continue with our usual work rhythm to provide our clients with the high-level customer communication and personalized trading and investment experience that characterizes us as an industry leader, ” Bogatenkov noted.

In addition to the largest-ever revenue and profit record, the company also set a record in the number of new customers, which grew by 260% at the group level compared to the same period last year. “Admiral Markets is today a financially secure company, offering its customers a successful partnership. Our focus is on aggressive clients’ growth. As a digitally developed company, one of the reasons for success is definitely our IT developments. The most prominent of these is the new trading application, which provides customers an even more personalized native trading experience than before,” explained the CEO. In addition, Admiral Markets performed extremely well in Southern and Western Europe, where growth in both customers and their assets exceeded expectations.

According to Sergei Bogatenkov, maintaining the social distance caused by the emergency was a challenge for everyone, but the company’s employees were extremely committed, realizing the seriousness of the situation and the need for self-management.

“I am very grateful to our team, because thanks to them, the first half of the year was the most successful ever in terms of business.”

Admiral Markets also significantly increased its brand awareness in the first half of the year. From now on, in Lennart Meri Airport in Tallinn, there is an Admiral Markets branded gate number 5.

“Quality is the key word that characterizes Admiral Markets. This is exactly the kind of trading and investment experience we offer to our clients, and it has brought us recognition from international financial institutions. To date, we have won more than 40 international awards for our service, quality and contribution to the promotion of financial education,” said Bogatenkov.

Statement of Financial Position

| (in thousands of euros) | 30.06.2020 | 31.12.2019 |

| Assets | ||

| Due from credit institutions | 25,881 | 19,757 |

| Due from investment companies | 9,533 | 6,786 |

| Financial assets at fair value through profit or loss | 11,915 | 9,759 |

| Loans and receivables | 6,842 | 3,983 |

| Other assets | 1,098 | 912 |

| Long-term investments | 4,180 | 0 |

| Tangible assets | 1,365 | 1,283 |

| Right-of-use asset | 4,447 | 4,059 |

| Intangible assets | 546 | 630 |

| Total assets | 65,807 | 47,169 |

| Liabilities | ||

| Financial liabilities at fair value through profit or loss | 133 | 66 |

| Liabilities and prepayments | 2,739 | 2,349 |

| Subordinated debt securities | 1,827 | 1,827 |

| Lease liabilities | 4,584 | 4,145 |

| Total liabilities | 9,283 | 8,387 |

| Equity | ||

| Share capital | 2,586 | 2,586 |

| Statutory reserve capital | 259 | 259 |

| Retained earnings | 53,679 | 35,937 |

| Total equity | 56,524 | 38,782 |

| Total liabilities and equity | 65,807 | 47,169 |

Statement of Comprehensive Income

| (in thousands of euros) | 6M 2020 | 6M 2019 |

| Net gains from trading of financial assets at fair value through profit or loss with clients and liquidity providers | 39,878 | 14,940 |

| Brokerage fee income | 57 | 20 |

| Brokerage and commission fee expense | -8,338 | -5,352 |

| Other trading activity related income | 12 | 22 |

| Other trading activity related expense | -18 | -9 |

| Net income from trading | 31,591 | 9,621 |

| Other income | 611 | 421 |

| Other expense | -237 | -10 |

| Interest income calculated using the effective interest method | 48 | 34 |

| Interest income similar to interest | 98 | 82 |

| Interest expense | -122 | -75 |

| Net gains on exchange rate changes | -250 | 87 |

| Personnel expenses | -3,950 | -3,343 |

| Operating expenses | -7,855 | -5,170 |

| Depreciation of tangible and intangible assets | -292 | -254 |

| Depreciation of right-of-use assets | -263 | -170 |

| Profit before income tax | 19,379 | 1,223 |

| Income tax | -266 | -311 |

| Profit for the reporting period | 19,113 | 912 |

| Comprehensive income for the reporting period | 19,113 | 912 |

| Basic and diluted earnings per share | 47.31 | 2.26 |