eToro UK Revenues plummet 57% in 2022 as crypto trading slows

eToro (UK) Limited, the London-based FCA regulated arm of Israeli Retail FX and CFDs broker eToro, has released its financial results for 2022 indicating a sharp decline in activity as eToro cut costs drastically following a failed IPO attempt in 2021-2022.

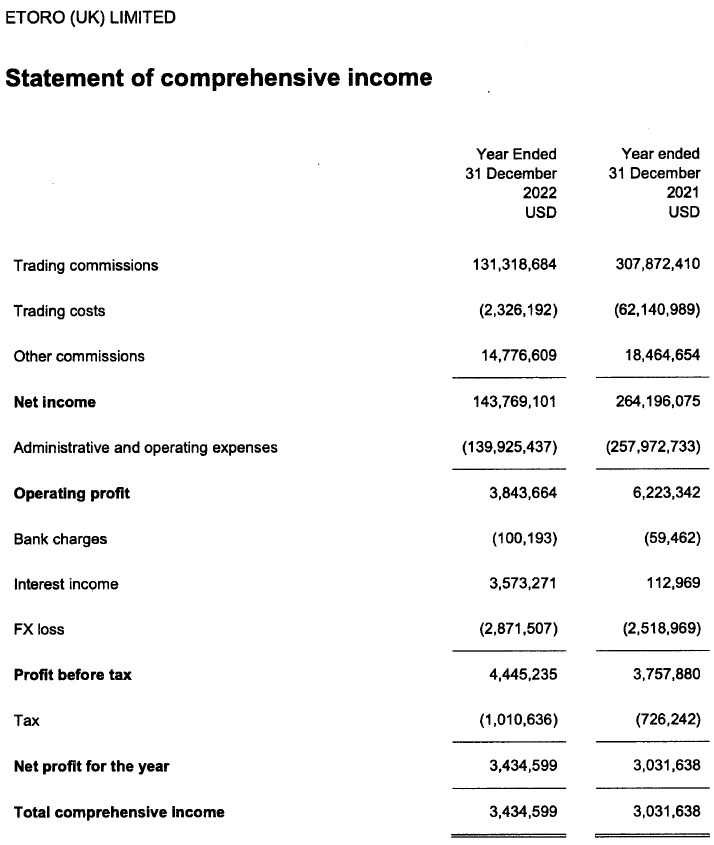

Revenue at eToro UK fell by 57% in 2022, to $131.8 million from $307.9 million the previous year. The company cut its Admin expenses from $258 million in 2021 to $140 million in 2022 – mainly marketing outlay – which led to a similar bottom line result of a $3.4 million net profit in 2022 (2021: $3.0 million).

We believe that what we see at eToro UK was seen across the eToro group globally last year – we had previously reported that overall eToro Revenues fell by about 50% in 2022, to $631 million from about $1.2 billion in 2021. eToro hasn’t released data on how much money the company earned or lost in 2022.

Clients’ money held at eToro UK declined by 22%, to $250.4 million as at year-end 2022, down from $322.2 million in 2021.

eToro UK commented that the fall in Revenue can be attributed to a significant reduction in trading activity across the year, particularly in crypto. However the UK business continued to add new users at an impressive rate, adding almost 100,000 more funded UK accounts, whilst also retaining existing clients, yet many sat on the sidelines in 2022.

eToro’s valuation has declined steadily over the past two years, following the company’s attempt to go public in 2021 via a merger with special purpose acquisition company (or SPAC) FinTech Acquisition Corp V, at a valuation of over $10 billion. Most recently, this summer a number of private eToro share sales by employees and early-eToro-investors were effected at a reported “slight discount” to the $3.5 billion valuation at which eToro raised money from some of its existing investors earlier this year.

eToro UK’s income statement and balance sheet for 2022 follow.