eToro research reveals luxury fashion stocks outperform high street brands in the past 5 years

New research from eToro reveals that luxury fashion stocks have generated more than quadruple the returns of their high street counterparts in the past five years.

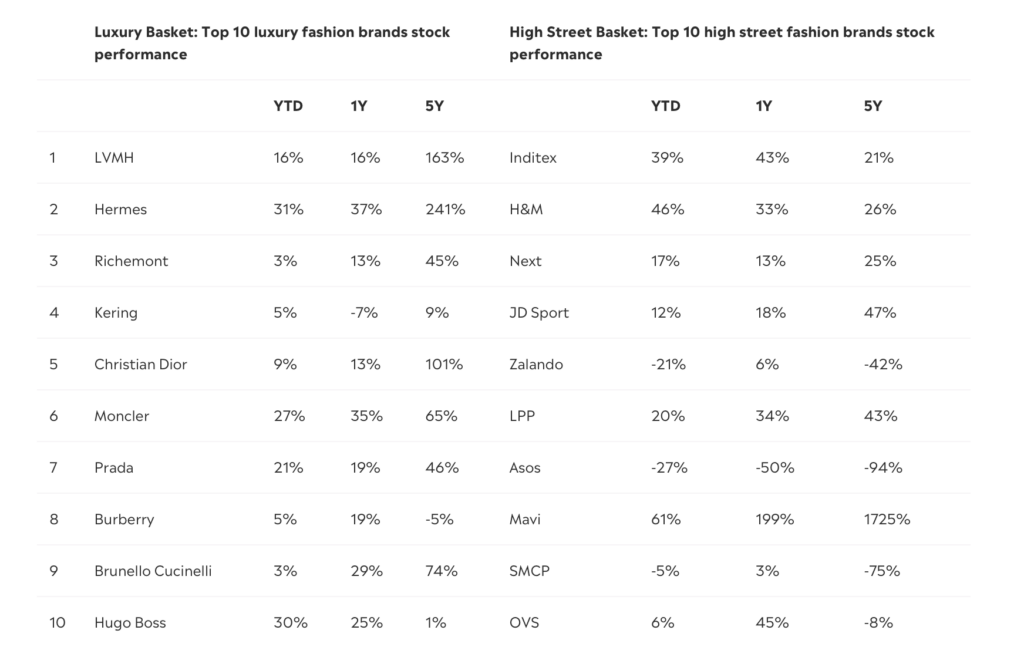

eToro’s Fashion Week basket looked at the performance of the ten largest UK and European luxury and high street fashion retailers by market cap, and found that luxury fashion brands have significantly outperformed their high street counterparts in recent years.

The top 10 luxury fashion stocks have recorded 90% growth in the past five years, in comparison to a modest 23% registered by their fast fashion counterparts.

Leading the luxury pack are fashion titans LVMH and Hermes, who have reaped the rewards of their strong brand identity, pricing power, and customer loyalty. Over the past five years, LVMH has witnessed a staggering 163% increase in its market value, while Hermes boasts an astonishing growth rate of 241%.

In stark contrast, European high street retailers have registered more modest growth. Spain’s Inditex, the parent company of fashion giant Zara, has seen 21% growth over the past five years, behind Sweden’s H&M with a 26% increase, and the UK’s Next with 25% uptick. ASOS was the worst performer, experiencing a significant downturn with a 94% decrease.

Noteworthy outliers in this scenario are the smaller players in the industry. Online retailer Turkey’s MAVI, a denim brand, has seen a 1,725% surge in value.

“LVMH’s meteoric rise to be Europe’s largest market cap stock shows the enduring allure of luxury brands, even in the face of the economic uncertainties and a cost-of-living crisis that has seen mainstream shoppers tighten their belts.” explained Ben Laidler, Global Markets Strategist at eToro.

“The high street brands deserve credit for navigating this difficult economic environment well, with their collective share prices besting the broader European stocks average. However, the share price plunge of ASOS for example, is a stark reminder of how unforgiving and competitive the industry can be. This underscores the importance of adaptability and innovation in the ever-changing fashion industry. As the sector continues to evolve, we can expect to see further shifts in the fortunes of these mainstream brands”

Despite the long-term challenges faced by high street brands, both luxury and high street fashion retailers in the UK and Europe have consistently outperformed the broader European stock market. Over the past five years, the top 10 luxury fashion stocks have outpaced the Stoxx600 by an impressive 4:1 ratio.

Meanwhile, eToro’s basket of top 10 high street brands has recently staged a modest yet encouraging comeback over the past year, registering a 25% increase compared to the 4.3% of the Stoxx500.

Ben Laidler concluded:

“Wage increases and a reduction in inflation pressures have combined to give consumers a renewed sense of confidence and purchasing power recently, demonstrating the delicate balance between macroeconomic conditions and the consumer-driven fashion industry. With economic growth now slowing in Europe both luxury and high street retailers may be forced to adapt again.”