Dukascopy triples Q1 Revenue as COVID-19 drives volatility

Add Dukascopy’s name to the list of Retail FX brokers seeing a rapid rise in Revenues and Profits during the COVID-19 pandemic.

The Geneva-based broker took the unusual step today of publicly releasing its quarterly results for Q1-2020. Dukascopy usually puts out an Annual Report and a semi-annual financial situation update. We assume they did that because, frankly, they had a great Q1.

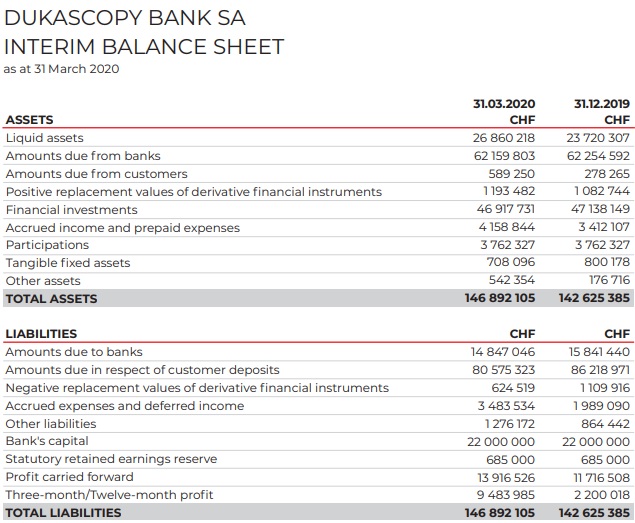

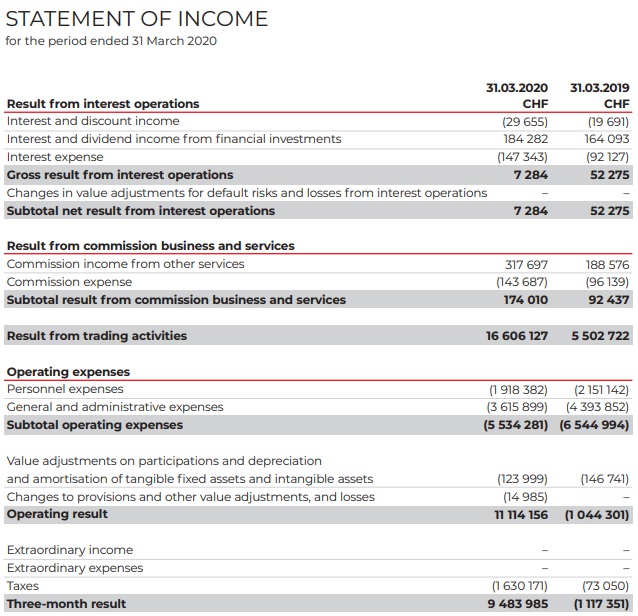

To the figures….. Dukascopy reported Q1-2020 Revenues of CHF 16.6 million (USD $17.1 million), more than triple the CHF 5.5 million Dukascopy brought in during Q1-2019. And with operating expenses actually lower this year than last following steps Dukascopy has taken to streamline its business, the company’s Q1-2020 Net Income of CHF 9.5 million (USD $9.8 million) compares very favorably to its Q1-2019 loss of CHF 1.1 million. Dukascopy had earned CHF 2.2 million in all of 2019.

The company further announced that its positive momentum continued into April, although not at quite the same pace, with April profits coming in at 969,000.

Dukascopy’s great Q1 follows on three fairly disappointing years for the broker, which saw Revenues dip from CHF 29.1 million in 2017, to 27.4 million in 2018 and then leveling off at 28.0 million in 2019. In each of those years Dukascopy operated at or near breakeven.

Dukascopy’s Q1-2020 balance sheet and income statement follow below.

May 12, 2020 @ 4:13 pm

so why would they give out results they don’t have to?

May 12, 2020 @ 4:39 pm

Simple really. Forex brokers rely on credibility, especially when it comes to larger traders – HNW individuals, institutions, etc. Reminding them that Dukascopy is a very profitable firm, with capital of so-and-so, is a key marketing element. Would you want to trade with a broker which is losing money?