CMC Markets registers 63% Y/Y jump in net operating income in FY2021

UK online broker CMC Markets Plc (LON:CMCX) today posted its financial results for the full year to March 31, 2021, with income beating forecasts.

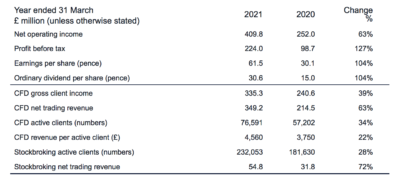

Net operating income increased to £409.8 million, up £157.8 million (63%) from the result recorded in the preceding year. As guided earlier, the result was ahead of forecasts.

CFD revenue per active client rose 22% to £4,560, driven by improved CFD client income retention, whereas the number of CFD active clients increased by 19,389 (34%) partially driven by increased levels of interest in the financial markets from a new wave of clients.

Stockbroking net trading revenue jumped 72% to £54.8 million supported by higher client numbers (up 28%) and the increasing appeal of the international shares offering.

The broker continued its investment in proprietary technology platforms to diversify the offering, with new Dynamic Trading and Spot FX offerings launched in May and June 2021 respectively, along with a native mobile app for Stockbroking in March 2021.

Operating expenses increased by 22% to £184.0 million, predominantly due to higher personnel costs as a result of recruitment to support ongoing strategic initiatives, increased marketing costs to capitalise on market opportunities, and trading related variable costs.

Profit before tax increased 127% to £224.0 million (2020: £98.7 million).

Across regions, CMC Markets’ established markets consist of the UK, Germany and Australia, geographies where it still sees good opportunities for growth and appetite for its offering.

The UK region displayed strong growth in the year, with record increase in active clients of 45% to 20,077, with the launch of Dynamic Trading in May 2021 and Spot FX in June 2021 responding directly to client requests and positioning the Group for further growth.

In Germany, the Group saw a record increase in active clients, resulting in strong growth.

CMC Markets’ Australian business continues to perform very well with CFD net trading revenue during the year rising to £100.3 million, which now accounts for 29% of CFD net trading revenue for the Group. The Group says it is well prepared for, and welcoming of, the ASIC measures and the company does not believe they will have a material impact on revenue in the medium term. The stockbroking business also continues to display strong growth.

In terms of outlook, the Board remains confident in achieving net operating income in excess of £330 million for 2022.

The Group’s significant investment in technology development, including the build of a non-leveraged trading platform for UK clients, is expected to lead to a moderate increase in operating costs in the coming financial year.

CMC Markets declared a final dividend of 21.43 pence per share (total dividend of 30.63 pence per share), in line with the dividend policy. The Board remains committed to paying a total dividend of 50% of profit after tax, balancing investing in long-term success and providing shareholders with superior returns.