ADSS UK revenues dive (another) 34% in 2021, looks to Retail clients

ADS Securities London Limited, the FCA regulated UK arm of UAE-based FX broker ADSS, has reported its financial results for 2021 indicating a further erosion in activity.

During 2021 the company said it saw a 34% YoY decrease in revenues (excluding Transfer Pricing) which was a result of the continued pivot from an institutional led offering to that of one centered around professional clients. No material impact was seen as a result of Brexit or COVID-19. The board said it remains committed to its strategy of predominantly focusing upon the retail and professional client sectors within the UK in the short to medium term.

Client money held by ADSS UK decreased by 36% to £9.1 million at year-end 2021 from £14.3 million in 2020.

ADSS UK stated that a key focus of the business strategy for 2022 is growing and diversifying the client base. For the professional client segment the key focuses are around a personalised and experienced sales trading service, supplemented by competitive pricing and execution. The institutional offering has been withdrawn from the market, but the firm is set to recommence marketing and sales activity with retail classified clients in 2022.

The ADSS Group is currently undergoing a transformation program and is looking to enhance all areas of the business. This includes the development of a new trading platform that is expected to be operational in ADSS UK in the second half of 2022.

ADSS lost a number of its top executives in 2021 (a trend which continued into 2022), including ADSS UK CEO Paul Webb who joined Equiti Capital, Chief Compliance Officer Roland Danielczyk, and Head of Front Office Michael Taylor.

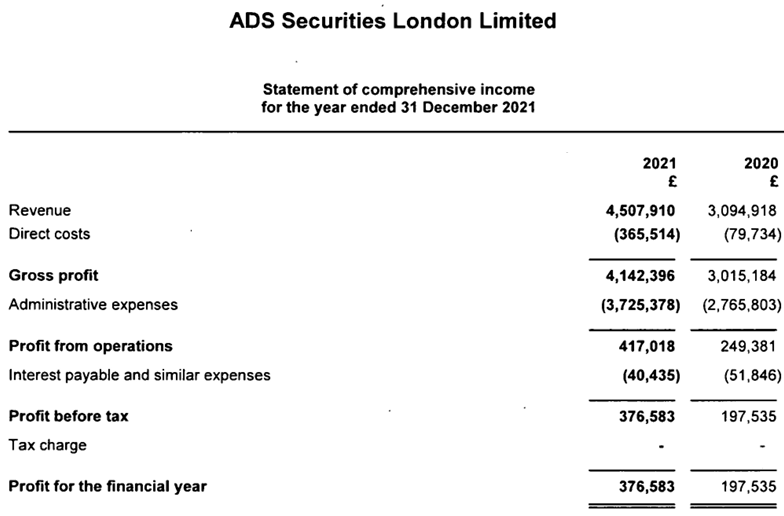

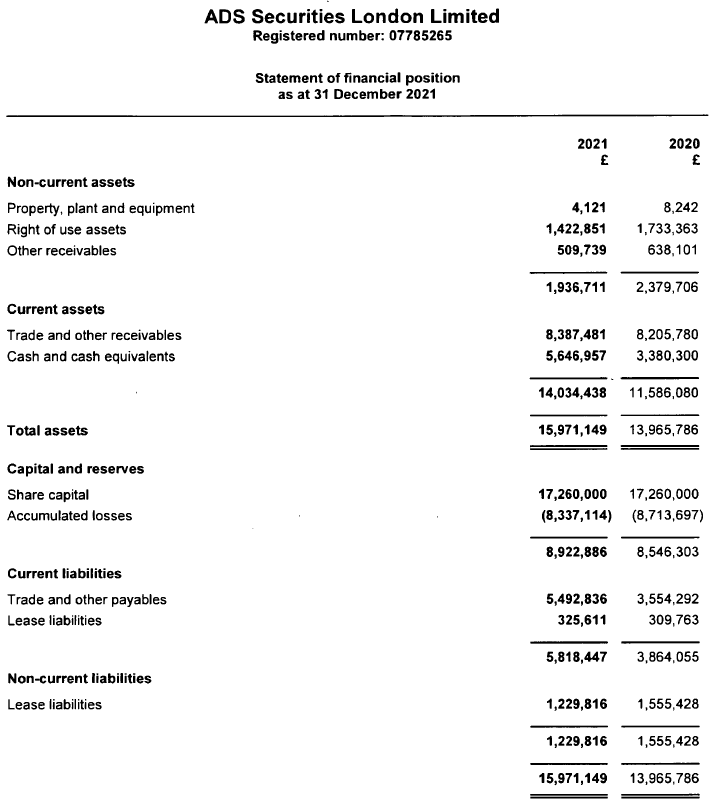

ADSS UK’s income statement and balance sheet for 2021 follow.