Swiss regulator publishes annual assessment of systemically important institutions for 2022

The Swiss Financial Market Supervisory Authority (FINMA) today publishes its annual assessment of recovery and resolution planning by systemically important Swiss financial institutions for the 2022 reporting period. The Resolution report does not take account of subsequent events, in particular the merger of UBS and Credit Suisse.

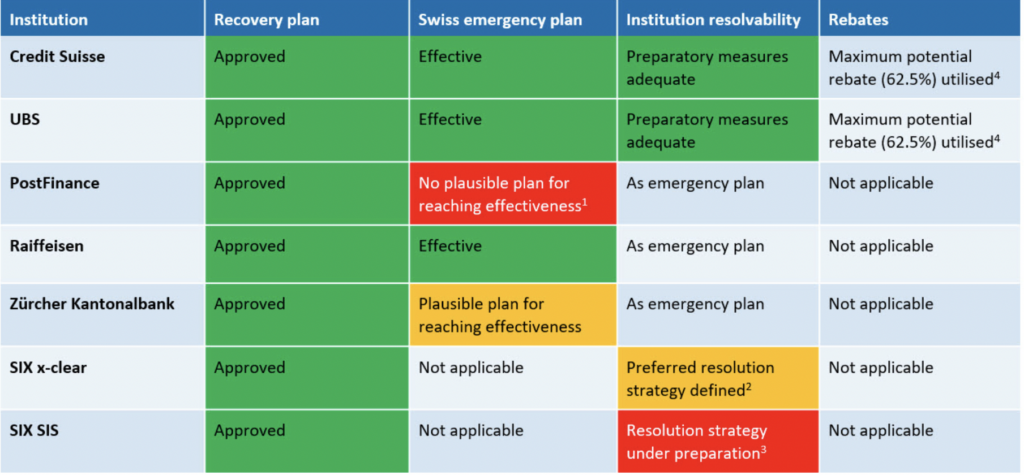

Every year FINMA assesses the progress made in recovery and resolution planning by the systemically important banks Credit Suisse, UBS, PostFinance, Raiffeisen and Zürcher Kantonalbank and the systemically important financial market infrastructures SIX x-clear and SIX SIS. It has published its reporting on this since 2020, and is doing so again in 2023, as provided for in the Banking Ordinance.

In their recovery planning, the institutions show how they would stabilise themselves in a crisis. The resolution planning is intended to show how systemically important institutions can be restructured or liquidated on the basis of the existing statutory TBTF rules, while maintaining their Swiss systemically important functions.

The institutions submitted their emergency planning documents by mid-2022. The resolvability work by the large banks was assessed as it stood at the end of 2022. The events surrounding Credit Suisse in the first quarter of 2023 are therefore not taken into account in the Resolution report. However, these events will be taken into account in the future as the institutions continue to develop their recovery and resolution planning.

Urban Angehrn, FINMA CEO, commented:

“The rules for systemically important institutions provide for crisis preparations in addition to increased capital and liquidity requirements. The events surrounding Credit Suisse show how important it is to make concrete preparations for crises. This meant that the authorities had options on the table with the restructuring plan and with the emergency plan that simply did not exist ten years ago. At the same time, it is clear that there are important lessons to be learned from the Credit Suisse crisis for future crisis preparations. FINMA will contribute to this objective.”

Thanks to further operational progress, the two large Swiss banks continued to improve their global resolvability in 2022. Resolvability means creating the conditions for successfully restructuring a systemically important bank in a crisis, or allowing it to exit the market by way of bankruptcy. The large banks have finalised their planning and operational capabilities in the areas of “valuation” and “restructuring”, tested them and also coordinated them with foreign authorities.

Further improvements in implementation were made in the areas of “liquidity” and “completion of a bail-in”. They were essentially able to meet the requirements in the area of “operational continuity”. FINMA continued to view the Swiss emergency plans of Credit Suisse and UBS as ready to implement.

For the first time, Raiffeisen’s emergency plan meets the requirements for the uninterrupted continuation of systemically important functions if the bank were to be at risk of insolvency. Raiffeisen can provide sufficient capital to be recapitalised and continued in the event of a crisis.

The emergency plan for Zürcher Kantonalbank (ZKB) is still not yet ready to implement, as ZKB has not reserved sufficient capital for recapitalisation in a crisis. However, it has begun to build up the corresponding funds by issuing bail-in instruments.

PostFinance must realign its emergency recapitalisation strategy following the decision not to approve the revision proposal for the Post Organisation Act.

FINMA approved the recovery plans of the central counterparty SIX x-clear and the central securities depository SIX SIS for the first time without conditions.

As part of the provisions on systemically important institutions, the amendments to the Liquidity Ordinance came into force on 1 July 2022, with a transitional period until the beginning of 2024. These amendments further develop the liquidity requirements for systemically important institutions.