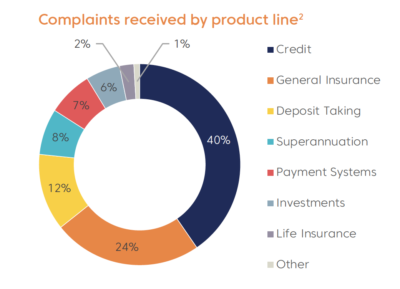

Investments account for 6% of complaints received by AFCA in 2020-21

Australians in dispute with banks, insurers, super funds, investment firms and financial advisers lodged more than 70,000 complaints with the Australian Financial Complaints Authority (AFCA) in the past 12 months.

They secured more than $240 million in compensation and refunds after seeking AFCA’s help, as well as outcomes such as fee waivers, debt forgiveness and apologies.

In addition, AFCA’s investigations into a range of systemic issues resulted in remediation payments to consumers totalling nearly $32 million in the past financial year. AFCA has now helped to secure more than $610 million in compensation and refunds, and over $220 million in remediation payments, since starting operation on 1 November 2018.

The most complained about product in 2020-21 was credit cards, accounting for 14% of all complaints, followed by home loans (9%) and personal transaction accounts (8%). With credit cards, the most common issues were default listings and unauthorised transactions – the latter accounting for 11% of card complaints.

Investments accounted for 6% of the complaints.

Government support, business relief measures and a steadying economy had a positive effect on complaint levels in 2020-21, including complaints involving financial difficulty, AFCA’s Chief Ombudsman, David Locke, said.

“Significantly, complaints involving financial difficulty were down nearly 40 per cent from the numbers we saw the previous year,” Mr. Locke said. “That’s a great outcome and reflects the positive response from government and industry to the impact of COVID.

Overall, complaints were down 12% on 2019-20, a year that included the initial months of the COVID-19 pandemic and a spike in complaints in areas such as travel insurance.

The past 12 months included 165 complaints related to insurance cover for business interruption associated with COVID-19. More complaints are expected in the coming year, once the second of two test cases brought by the insurance industry is resolved.

Complaints related to personal transaction accounts rose 48%, with unauthorised transactions accounting for 29% of those complaints. Also, complaints about electronic banking increased 76%, with unauthorised transactions accounting for 28% of those complaints and mistaken internet payments accounting for a further 19%.

“There’s no single reason for these increases but people transacting online more during COVID will have contributed,” Mr. Locke said. “Scams, which have accelerated during the pandemic, are also leading to growing complaints about transactions.”