France’s AMF reports decline in unlawful advertisements for FX and CFD trading

France’s Financial Markets Authority (AMF) today published its latest Newsletter concerning household savings. The document reveals a decline in the volume of aggressive advertisements of online trading instruments such as contracts for difference (CFDs).

There are still many inducements to engage in speculative trading, the regulator says. In 2020, however, aggressive or imbalanced advertisements for complex and risky financial instruments have been far less numerous. This is seen as a result of the action of the European regulators (ESMA’s product intervention measures, in particular) and a sign that investor protection is progressing.

The regulator also stresses the importance of the “Sapin 2” Act, which came into force in France in 2017. FX News Group’s readers may recall that “Sapin 2” imposed a ban on all forms of advertising sent directly or indirectly, via electronic media (emailing, online advertising banners, radio, television, etc.), to private individuals concerning financial instruments that are very hard to understand and potentially very risky (FX, binary options, highly-leveraged CFDs, etc.).

The AMF stresses that it conducts active monitoring to detect such prohibited advertising. It has seen a significant fall in the number of these advertisements detected, from 94 in 2017 to 10 in 2019. In the first half of 2020, only two prohibited advertisements were identified.

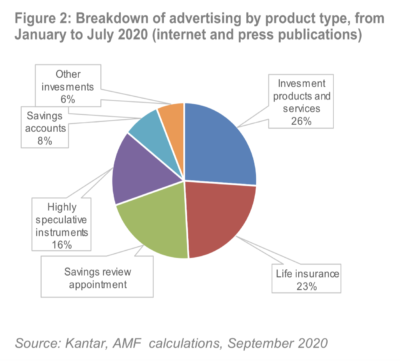

In advertising for investments, the proportion of advertisements for investment products, excluding highly speculative trading, remains stable (26% from January to July 2020, versus 24% in 2019).

Of the investment advertisements (excluding inducements for highly speculative trading), collective investment products account for about one out of two ads. Half of these ads concern investments in rental property (SCPIs). They are frequently posted by asset management companies specialised in these products.

Advertisements for investment services are less numerous (17% in 2018, 6% in 2019, 4% in 2020): online investment specialists have refocused their communications on their life insurance contracts.

While advertising for investment products and services is usually disseminated on media intended for the general public (six out of 10 ads), either via the internet or in newspapers and magazines, this is not the case for public offers of financial securities (IPOs, public tender offers), which usually target investors.

From January to July 2020, advertisements of this type represented one-third of the ads identified. Half of them concerned initial public offerings.