Forex tops list of investment complaints received by AFCA in 2019/20

The Australian Financial Complaints Authority (AFCA) today published its 2019-20 Annual Review, revealing the number of complaints received and closed, the amount awarded to consumers in compensation and refunds.

According to the AFCA Annual Review, between 1 July 2019 and 30 June 2020 AFCA received 80,546 complaints from consumers and small businesses, which is a 14% increase in the monthly average compared to the last financial year. A majority of complaints (58%) lodged with AFCA in this period related to banking and finance, followed by general insurance (24%), superannuation (9%), investments and advice (6%) and life insurance (2%).

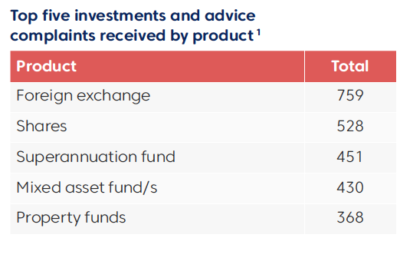

Investments and advice saw an increase of 22% in the average number of complaints received each month during the 2019–20 financial year, receiving a total of 4,615 complaints. This year, these complaints made up 6% of the total complaints received by AFCA.

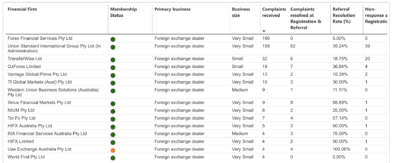

Forex was the product at the core of most of the complaints in the Investments and advice category. AFCA received a total of 759 complaints about FX in 2019/20.

Forex was the product at the core of most of the complaints in the Investments and advice category. AFCA received a total of 759 complaints about FX in 2019/20.

There were 4,261 investment and advice complaints closed during the year, including 1,306 received before 1 July 2019. More than $53.4 million in compensation and refunds was awarded or obtained through AFCA’s dispute resolution work.

The majority (75%) of the resolved complaints that proceeded to Case Management were finalised through AFCA facilitating an agreement between the parties about the best way forward for both parties to be satisfied with the outcome.

Where AFCA had to provide a view on the merits in the remaining 25% of complaints, the view was in favour of the complainant 56% of the time, and in favour of the financial firm 44% of the time.

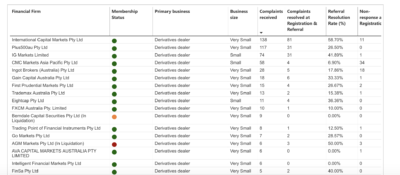

AFCA also saw 1,042 investments and advice complaints relating to financial planners or advisers, representing 23% of all investments and advice complaints. The next highest industry type for investments and advice complaints was derivatives dealers who received 557 complaints. The average time taken to close complaints was 117 days, and 1,633 complaints were closed within 60 days. While the timeframes have increased from the 2018–19 reporting period, this is a reflection of the increased workflow.

Closure rates for complaints received in the 2019–20 reporting period and the impact of COVID-19 in recent months have led to increased timeframes for information exchange.

AFCA’s Annual Review does not name any of the firms that were targeted by the complaints. However, such data is revealed in AFCA’s DataCube. Below you can view the tables including the names of the Forex dealers and Derivatives dealers in Australia for the period July 1, 2019 to June 30, 2020.

AFCA is a one-stop shop for consumers and small businesses that have a dispute with their financial firm over issues such as banking, credit, general insurance, financial advice, investments, life insurance or superannuation.

On 1 November 2018, AFCA replaced the Financial Ombudsman Service (FOS), the Credit and Investments Ombudsman (CIO) and the Superannuation Complaints Tribunal (SCT) as the one-stop shop for financial dispute resolution. All outstanding complaints with FOS and the CIO were transferred to AFCA and the body haas continued to finalise these matters.