FCA receives 289 new whistleblowing reports in Q3 2021

The UK Financial Conduct Authority (FCA) has published its latest quarterly data on whistleblowing. In the third quarter of 2021 (July-September), the FCA received 289 new whistleblowing reports.

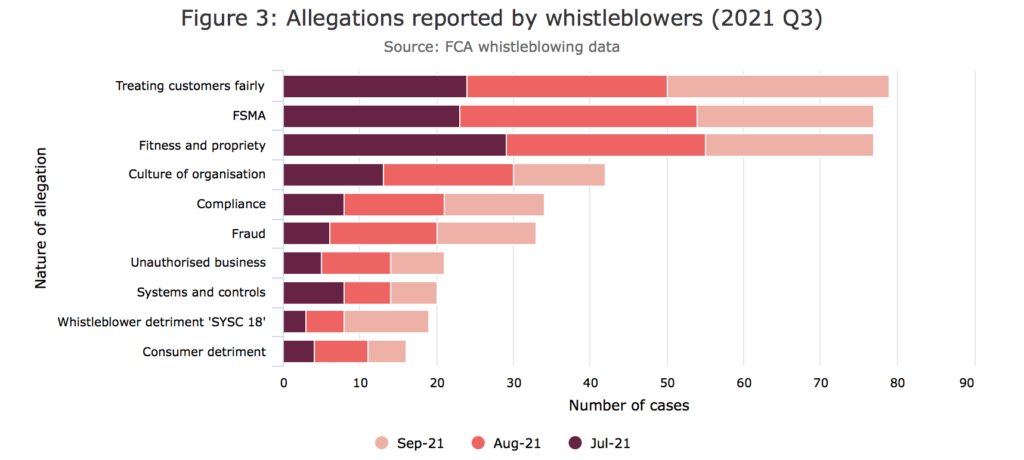

Every report the FCA receives contains one or more allegations of wrongdoing. This is why the data shows that the regulator received 289 reports but 518 allegations. The top allegations for the third quarter concerned treating customers fairly, FSMA, and fitness and propriety.

Whistleblowers are protected by the Public Interest Disclosure Act 1998 (PIDA), which means that you may obtain a remedy if you are hurt, suffer detriment or are dismissed because you have blown the whistle in the public interest. This is enforceable through an Employment Tribunal.

PIDA was introduced to encourage and give workers the legal support to speak up if they have concerns about wrongdoing in their workplace.

It makes provision about the subject matter of the disclosure, the motivation and beliefs of the worker, and the person(s) to whom the disclosure is made.

Whistleblowers can directly report wrongdoing to the FCA. The regulator has a special role under PIDA. Under PIDA, if a whistleblower makes a report to a prescribed person, such as the FCA, they will potentially qualify for the same employment rights as if they had made a report to their employer. If they do qualify, reporting to the employer directly is not required.

To qualify for these rights, as well as meeting the criteria found on GOV.UK, the worker must have a reasonable belief that:

- the matter being reported falls within the remit of the prescribed person, as described in the second column of the Schedule to the Prescribed Persons Order headed ‘Description of matters’;

- the information reported is substantially true.