EU watchdog imposes €28.5M fine on BofA, Crédit Agricole, Credit Suisse

The European Commission has imposed a fine of €28.49 million on Bank of America Merrill Lynch, Crédit Agricole, and Credit Suisse for breaching EU antitrust rules. Deutsche Bank was not fined as it revealed the existence of the cartel to the Commission.

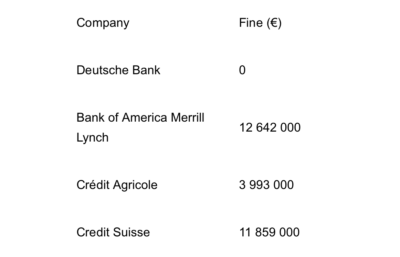

Bank of America Merrill Lynch will have to pay a fine of €12.64 million. Crédit Agricole will have to pay a fine of €3.99 million. Finally, Credit Suisse will have to pay a fine of €11.86 million.

The four banks took part in a cartel in the secondary trading market within the European Economic Area of Supra-sovereign, Sovereign and Agency (SSA) bonds denominated in US Dollars.

The four investment banks participated in a cartel through a core group of traders working in their USD SSA bonds divisions, who were in regular contact with each other. The traders, who were in direct competition, typically logged into multilateral chatrooms or bilateral chatrooms on Bloomberg terminals. They knew each other on a personal basis, thus creating a closed circle of trust. They provided each other with recurring updates on their trading activities, exchanged commercially sensitive information, coordinated on prices shown to their customers, or to the market in general and aligned their trading activities on the secondary market for these bonds.

The conduct took place during a five-year period and affected the trading of US denominated SSA bonds on the secondary market in the entire EEA.

The Commission’s investigation revealed that, further to coordination on prices quoted to specific clients or the market in general, the traders at times agreed:

- to refrain from bidding or offering, or to remove (or “kill”) a bid or offer from the market, when they might come into competition with one another;

- to split trades between each other and combine or reduce their respective positions to meet a specific customer’s demand, without the customer being aware that it was dealing with more than one trader which meant that in practice the customer had limited choice.

The behaviour of the four banks violates EU rules that prohibit anticompetitive business practices such as collusion on prices (Article 101 of the Treaty on the Functioning of the European Union and Article 53 of the EEA Agreement).