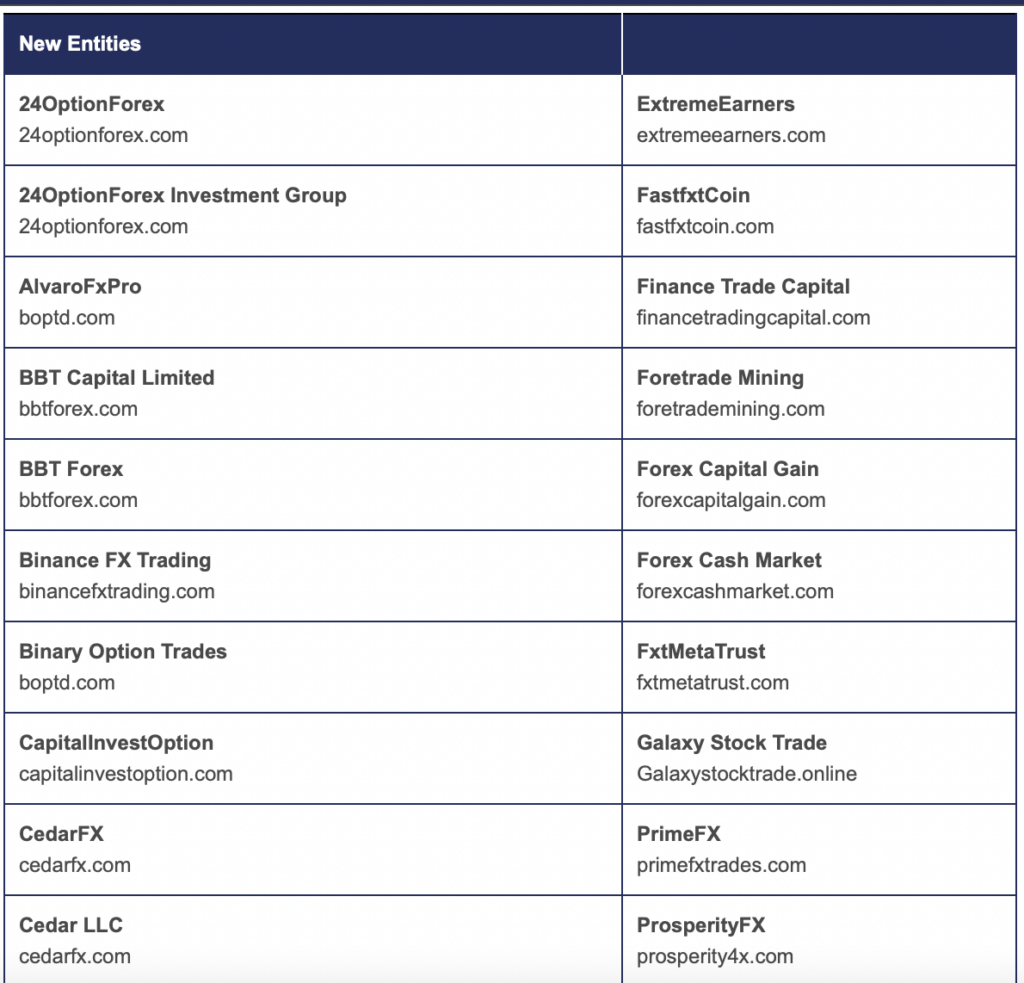

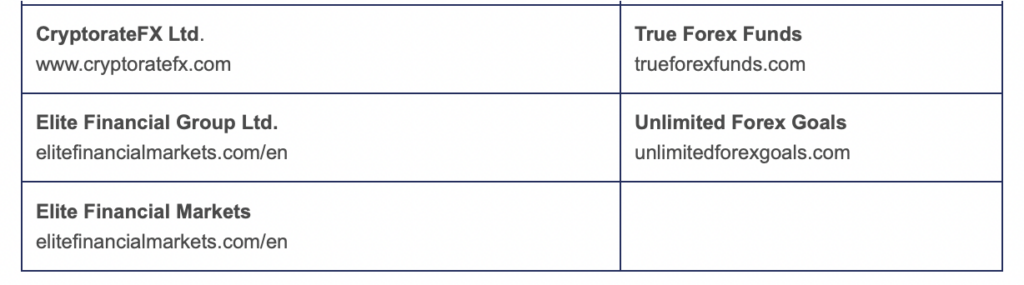

CFTC adds 45 firms to its Registration Deficient list

The Commodity Futures Trading Commission (CFTC) today added another 45 unregistered foreign entities to its Registration Deficient List (RED List).

“For nearly 10 years, the CFTC has listed entities on the RED List that have the potential to do irreparable financial harm to unsuspecting Americans,” said Director of Enforcement Ian McGinley. “It is for this reason, we strongly encourage all customers to check the RED List before they trade because they may have little or no protections if they choose to trade with unregistered firms that operate outside the U.S.”

Launched in 2015, the CFTC’s RED List now contains more than 240 entities. A firm is added to the RED List when the CFTC determines, from investigative leads and questions from the public, that it is not registered with the CFTC and appears to be acting in a capacity that requires registration, such as trading binary options, Forex, or other products.

The Commodity Exchange Act generally requires intermediaries in the derivatives industry to register with the CFTC. An “intermediary” is a person or firm that acts on behalf of another person in connection with trading futures, swaps, or options. Depending on the nature of its activities, an intermediary may also be subject to various financial, disclosure, reporting, and recordkeeping requirements.

There are some exceptions or exemptions where an intermediary does not require registration; however, entities on the RED List do not meet the criteria for an exception or exemption.

The RED List is circulated to financial industry partners, including other regulators, consumer groups, industry participants, self-regulatory organizations, exchanges, and industry associations. It complements registration information provided by the National Futures Association.