Saxo enables stock transfer track and trace on SaxoPartnerConnect

Multi-asset investment specialist Saxo Bank has enabled stock transfer track and trace on SaxoPartnerConnect.

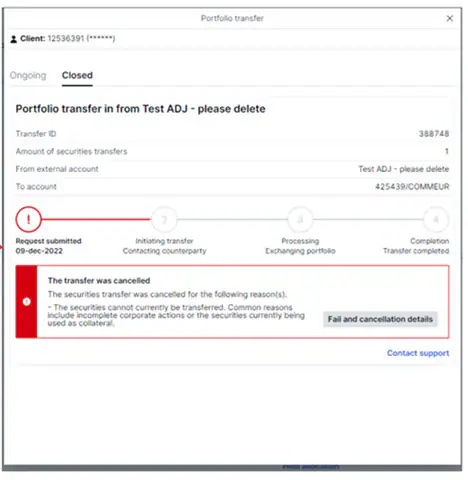

It is now possible to see the status of your end-clients’ stock transfers in SaxoPartnerConnect. This allows you to see the status of the transfer, any reasons for the status, and whether a stock transfer has failed or partially failed (and why).

The feature is available to all users of SaxoPartnerConnect and is read-only at this stage.

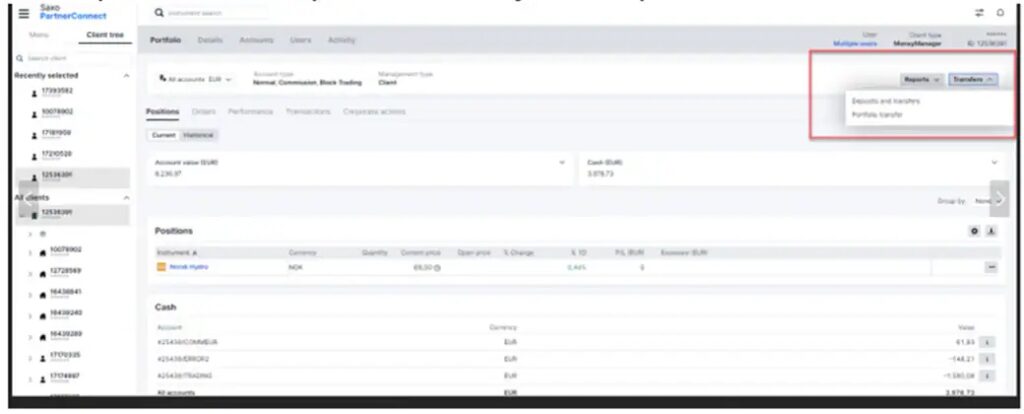

From the Transfers drop-down menu, select Portfolio transfer. The Portfolio transfer window provides you with the Transfer ID (which you can use when contacting Saxo regarding this transfer), transfer details, and the status.

There are 2 tabs: current ongoing transfers as well as closed transfers (which includes completed or cancelled).

SaxoPartnerConnect is a one-stop digital advisory solution that supports self-directed, advisory and discretionary business, enabling wealth managers to better service their clients, while offering scalability and reducing costs and complexities.

SaxoPartnerConnect’s key features include:

- The Model Manager: Partners can create dedicated model portfolios. These can be used for both discretionary and advised clients, and they can choose scheduled and ad-hoc rebalancing.

- SaxoAdvisor: Built into SaxoPartnerConnect, this suite of end-to-end financial advisory tools lets partners create investment proposals. It includes a digital client approval flow, advisory sessions spanning multiple accounts, and allows for accounts with different ‘management types’ on a single client. It can support advised accounts, managed accounts and self-directed accounts.

- Client screener: This allows users to get a full overview of their client base including the ability to generate portfolio and transaction reports in bulk.

- Efficient Client Management Portal: One stop system to access multi-asset classes with advanced allocation and rebalancing tools. The easy and efficient client management portal comes with digital communication throughout investment circle, letting advisors manage the full client lifecycle such as onboarding, funding, trading, corporate actions and renewal on behalf of clients.