Interactive Brokers clients can direct route their US options orders to IBUSOPT

Electronic trading major Interactive Brokers continues to expand the capabilities of its trading solutions. The latest (beta) version of the TWS platform enables clients of the broker to add liquidity with the IBUSOPT destination.

Clients who trade US options can now choose to direct route their options orders to IBUSOPT to participate in the retail order flow for US equity and index options. Orders routed to IBUSOPT will be held at this liquidity-providing destination, and will be eligible to participate in an exchange auction to potentially fill against other SMART-routed marketable orders from IBKR clients. Note that there is no guarantee that orders routed to IBUSOPT will fill.

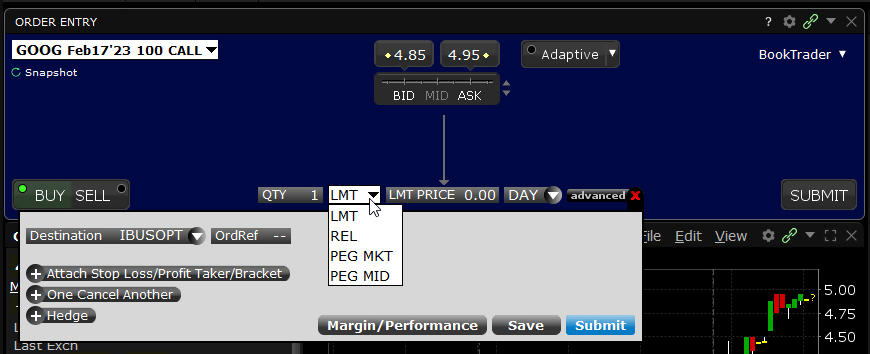

To route a US equity or index options order to IBUSOPT from Mosaic, set up the order in the Order Entry panel and open the “advanced” panel to select a new destination. Once traders have selected IBUSOPT as the destination, available order types will be shown in the dropdown.

Choose from a variety of order types to post liquidity to the IBUSOPT destination, including:

- Limit

- Relative/Pegged-to-Primary

- Pegged-to-Market

- Pegged-to-Midpoint

- IBUSOPT Pegged-to-Midpoint

- IBUSOPT Pegged-to-Best

Interactive Brokers has been regularly enhancing its TWS platform. The latest (beta) build of the TWS platform offers traders to discover ideas and new markets for potential investments using the Discover tool. Discover serves as a link to market-defining third-party content selected specifically to help traders improve their performance. Currently Discover supports content from Trading Central, a “premium, one stop shot for investment decision support.”