FD Technologies’ shareholders approve sale of First Derivative Business to EPAM Systems

FD Technologies (LON:FDP) announces that the Resolution put to Shareholders at the General Meeting of the Company held earlier today to approve the sale of the First Derivative Business to EPAM Systems, Inc was duly passed.

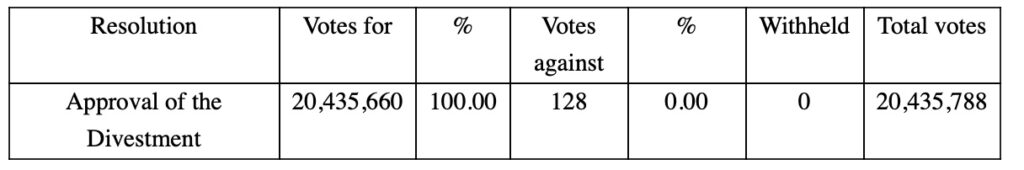

Voting was conducted by way of poll on the Resolution proposed at the General Meeting. The number of votes for and against the Resolution put before the General Meeting, as well as the number of votes withheld, were as follows:

The Divestment remains subject to certain other conditions set out in the Company’s announcement on 7 October 2024 and is expected to complete in the fourth quarter of 2024.

After customary closing adjustments, transaction and separation costs, net cash proceeds are expected to be approximately £205 million.

The Board of FD Technologies has been considering the options to maximise shareholder value for more than 18 months, taking independent advice throughout the process. In October 2023, a formal review of the Group structure was announced, which enabled extensive consultation with shareholders and input from advisers. The aim of the review was to determine the optimal organisational structure and allocation of capital to best drive value for shareholders.

On 1 March 2024, the Board announced that it had unanimously concluded that the separation of its three businesses (KX, the First Derivative Business and MRP) was the most effective way to achieve these objectives and was in the best interest of shareholders.