Cboe Silexx enhances Time & Sales module

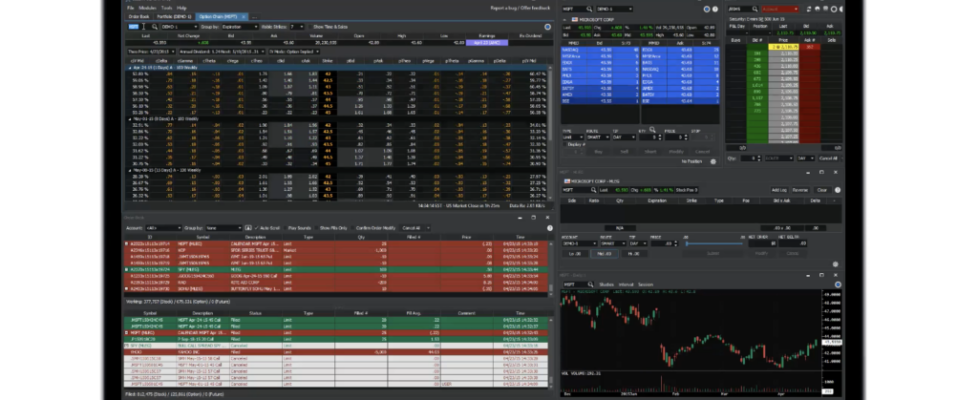

Cboe has announced further enhancements to Cboe Silexx, a multi-asset order execution management system (OEMS) that caters to the professional marketplace.

- The Post-Trade Allocation module allows users approved by their firm admin to allocate the entirety of their account’s completed trades at the most granular, individual trade level.

- Multi Order Ticket, Order Ticket, and Basket Trader now support up to seven place precision asset-specific pricing.

- Multiple enhancements have been added to the Time & Sales module, including support for “24×5” classes and enriched historical market data across all symbols.

Cboe Silexx has been regularly updated. In a recent release, the Position Analyzer module got to offer graphical representations of positions, P&L, and Greeks. Features include the ability to affect underlying price, evaluation date, and to add simulated positions.

Theoretical call and put value columns via Cboe Hanweck have been added to the Option Chain, Multi Order Ticket, and Quick Trade Ticket.

Market Data permission menu was added. Located in the tool bar of the application’s main window, the menu outlines delayed and real-time permissions.

CAT reporting of derived single and multi-leg crosses is now supported.