Cboe enhances Cboe Silexx platform

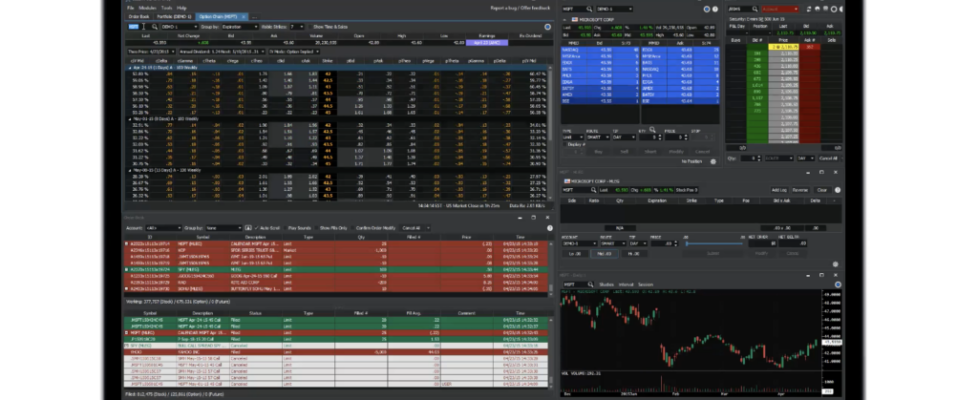

Cboe Silexx, a multi-asset order execution management system (OEMS) that caters to the professional marketplace, has been enhanced.

- Now, the platform enables Firm Administrators to create new accounts. To do that, go to Firm Accounts module > Click green plus sign > Create account. Right click on existing account > Select ‘Clone’ for convenience. Finally, confirm CAT and Risk settings. Firm Administrators can also configure FDID and Sender IMID field display in order tickets.

- There are enhancements to Order tickets. Thus, for instance, Flip Legs button resets order quantity.

- Multi-Order ticket allows price improvement for child credit orders.

- In addition, users of the platform can benefit from a simplified filter functionality in Order Manager and Order History.

- Let’s recall that Position Compression Cross (PCC) order type will be available October 28, 2020.

Upon the effective date, brokers will be able to enter the new electronic PCC paired-order type, which may be executed as an unexposed cross, to electronically execute compression trades. TPHs may continue to execute compression trades on the floor by entering single-sided compression orders to be executed on the floor via PAR, which may be executed as unexposed crosses beginning on the effective date. When entering a compression order for open outcry execution, the TPH must apply the “compression” flag to each order.

A number of criteria will apply to both floor-based compression and electronic PCC orders.

A compression order may be comprised of all closing positions or a combination of opening and closing positions as long as the closing volume is equal to or greater than the opening volume for each user or contra.

The Exchange will permit all positions (both opening and closing positions) in compression orders to be entered and executed in pennies. The legs of complex compression orders can be executed in $0.01 increments.

A TPH may not include a closing SPX position in a compression order unless that position was included on a compression list provided to the Exchange on the previous trading day/session by 6:00 p.m. ET. Also, the current allowance for complex compression orders with any ratio in open outcry will be extended to complex electronic compression orders.

Importantly, for compression orders, the execution price must be at or inside the BBO and better than the price of any priority customer order resting in the book (if the order is single-leg), must be at or inside the SBBO or better than the SBBO if there is a priority customer on any leg of the SBBO, and better than the price of a priority customer complex order on the COB (if the order is multi- leg).

Compression orders for complex orders will support up to 12 legs and up to 10 contra orders.