Broadridge registers sharp rise in earnings in Q2 FY21

Fintech major Broadridge Financial Solutions, Inc. (NYSE:BR) today reported its financial results for the second quarter of fiscal year 2021, that is, the quarter to end-December 2020.

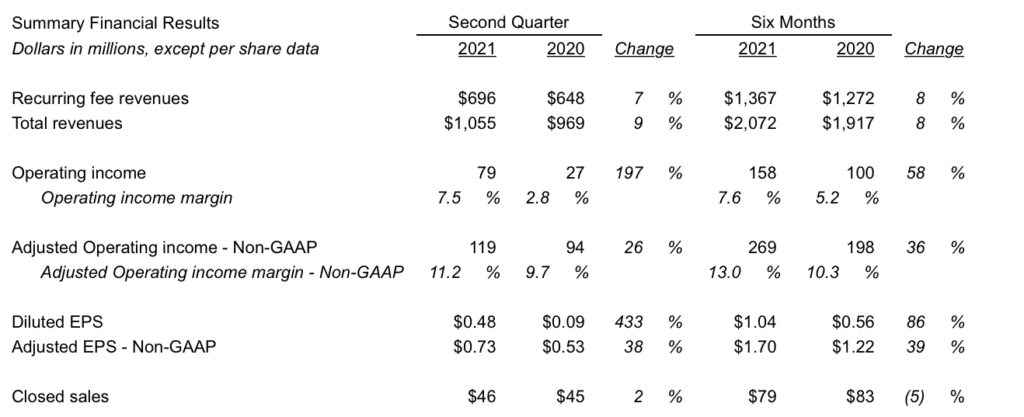

In the three months to December 2020, Broadridge registered total revenues of $1,055 million, a rise of 9% from the result of $969 million reported for the prior year period. Recurring fee revenues increased 7% from the year-ago period to $696 million. The increase was primarily driven by growth from onboarding of net new business, internal growth, and the impact of acquisitions.

Event-driven fee revenues increased $14 million, or 46%, to $45 million, due to increased mutual fund proxy and other communications. Distribution revenues increased $28 million, or 9%, to $345 million, driven by an increase in the volume of regulatory and event-driven communications.

Currencies negatively impacted revenues by $3 million due to a combination of foreign acquisitions and continued international revenue growth.

Operating income for the quarter to end-December 2020 was $79 million, an increase of $53 million, or 197%, from a year earlier. Operating income margin increased to 7.5% compared to 2.8% for the prior year period.

Net earnings jumped 457% to $56 million and Adjusted Net earnings increased 38% to $86 million.

Diluted earnings per share increased 433% to $0.48, compared to $0.09 in the prior year period and Adjusted earnings per share increased 38% to $0.73, compared to $0.53 in the prior year period. The increases in Diluted earnings per share and Adjusted earnings per share were primarily due to the increase in Recurring fee revenues and higher event-driven fee revenues.

Let’s note that Global Technology and Operations (GTO) marked Recurring fee revenues of $302 million, an increase of $21 million, or 8%, from the year-ago quarter The increase was attributable to the combination of organic growth (7pts) and revenues from acquisitions (1pt). Internal growth contributed 4 pts from higher equity trading volumes.

GTO earnings before income taxes were $55 million, an increase of $6 million, or 12%, compared to $49 million in the prior year period. The earnings increase was driven by higher organic revenues. Expense growth during the quarter was driven by onboarding of new business, accelerated spend on growth initiatives as well as the impact of recent acquisitions. Pre-tax margins increased to 18.2% from 17.4%.

“Our Fiscal 2021 outlook puts us squarely on track to achieve the three-year growth objectives we presented at our investor day two months ago, including 7-9% Recurring revenue and 8-12% Adjusted EPS growth,” Tim Gokey, Broadridge’s Chief Executive Officer commented.