Broadridge posts 7% Y/Y rise in revenues in Q3 FY23

Broadridge Financial Solutions, Inc. (NYSE:BR) today reported financial results for the third quarter ended March 31, 2023.

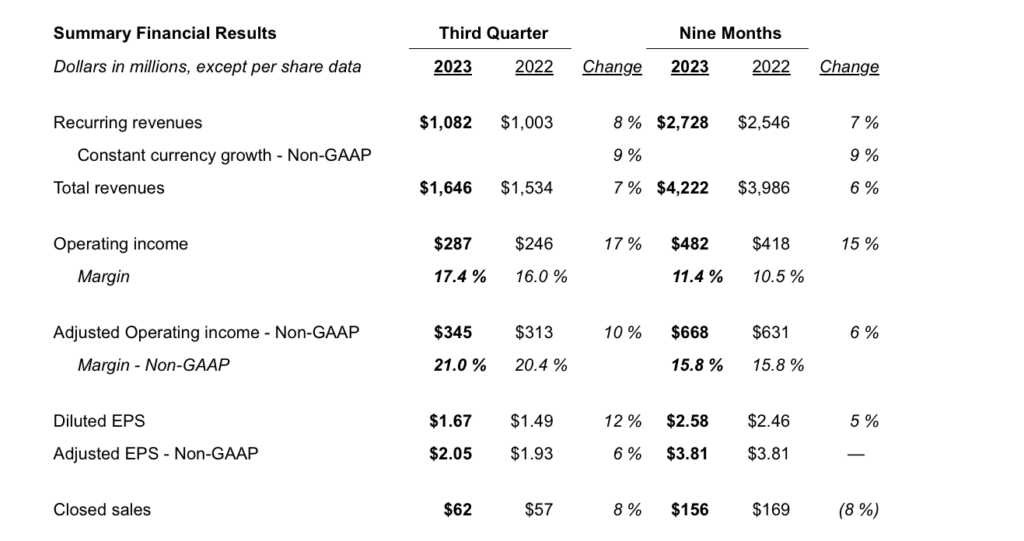

Total revenues for the third quarter of fiscal year 2023 increased 7% to $1,646 million from $1,534 million in the year ago period. Recurring revenues increased $79 million, or 8%, to $1,082 million. Recurring revenue growth constant currency (Non-GAAP) was 9%, all organic, driven by Net New Business in GTO and ICS and Internal Growth, primarily in Broadridge’s ICS business.

Event-driven revenues decreased $7 million, or 12%, to $52 million, primarily due to the decrease in volume of mutual fund proxy communications.

Distribution revenues increased $40 million, or 8%, to $512 million, primarily driven by the impact of the postage rate increase of approximately $33 million.

Operating income was $287 million, an increase of $41 million, or 17%. Operating income margin increased to 17.4%, compared to 16.0% for the prior year period, due to the growth in Recurring revenues and lower amortization expense from acquired intangible assets, more than offsetting lower event-driven revenues.

Adjusted Operating income was $345 million, an increase of $32 million, or 10%. The increase was primarily driven by higher Recurring revenues, partially offset by lower event-driven revenues.

Adjusted Operating income margin increased to 21.0% compared to 20.4% for the prior year period. The increase in pass through distribution revenues negatively impacted margins by approximately 18 basis points.

Net earnings increased 12% to $199 million and Adjusted Net earnings increased 7% to $245 million.

Diluted earnings per share increased 12% to $1.67, compared to $1.49 in the prior year period, and adjusted earnings per share increased 6% to $2.05, compared to $1.93 in the prior year period.

“Broadridge delivered strong third quarter results, with 9% growth in recurring revenue constant currency, continued growth in Adjusted EPS, and increasing free cash flow. We continue to benefit from underlying long-term trends, strong execution, and disciplined expense management” said Tim Gokey, Broadridge CEO.

“Broadridge is poised to deliver another year of consistent growth. We now expect Recurring revenue growth constant currency at the higher end of our 6-9% range and are reaffirming our outlook for 7-11% Adjusted EPS growth. Our continued strong performance positions Broadridge to deliver on its three-year growth objectives for the fourth consecutive cycle, with recurring revenue and Adjusted EPS growth at or above the higher end of our target range.”