Broadridge marks 10% Y/Y rise in revenues in Q3 FY22

Broadridge Financial Solutions, Inc. (NYSE:BR) today reported financial results for the third quarter ended March 31, 2022 of its fiscal year 2022.

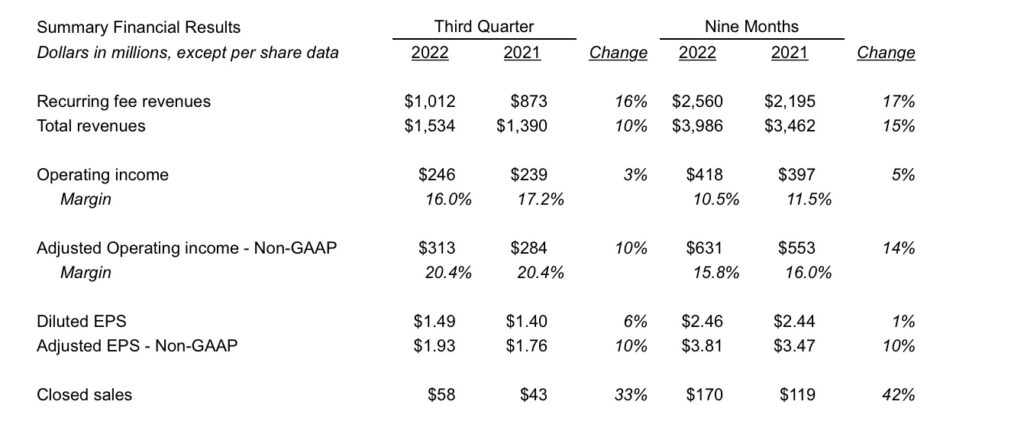

Total revenues in the first three months of 2022 increased 10% to $1,534 million from $1,390 million in the prior year period. Recurring fee revenues increased $139 million, or 16%, from $873 million. The increase was driven by 3pts of Net New Business and 3pts of Internal Growth.

Growth in Net New Business contributed to growth in both Investor Communication Solutions (ICS) and Global Technology and Operations (GTO) recurring fee revenues, while the contribution from Internal Growth was driven by higher Record Growth in Broadridge’s ICS business from equity positions of 17% and interim positions of 10%. Growth from acquisitions of 9pts was primarily driven by the Itiviti acquisition which closed in May 2021.

Event-driven fee revenues decreased $14 million, or 20%, to $59 million, primarily due to the decrease in volume of equity contest and other communications.

Distribution revenues increased $25 million, or 6%, to $472 million, primarily driven by higher revenues from customer communications, including the impact of a current year postage rate increase of approximately $25 million, offset by lower volumes of regulatory mailings.

Operating income was $246 million, an increase of $7 million, or 3%. Operating income margin decreased to 16.0%, compared to 17.2% for the prior year period due to higher amortization expense from acquired intangible assets, an increase in low-margin distribution revenues, growth investments and other expenses, more than offsetting growth in recurring fee revenues.

Net earnings increased 7% to $177 million and Adjusted Net earnings increased 10% to $228 million.

Diluted earnings per share increased 6% to $1.49, compared to $1.40 in the prior year period, and Adjusted earnings per share increased 10% to $1.93, compared to $1.76 in the prior year period.

Tim Gokey, Broadridge’s CEO, commented:

“Broadridge delivered another strong quarter, with 16% recurring revenue and 10% Adjusted EPS growth. Our growth is being propelled by long-term trends and by the continued execution of our strategy.

“Broadridge is poised to deliver another year of strong growth. Based on our strong performance to date and visibility into our seasonally larger fourth quarter, we continue to expect fiscal year 2022 recurring revenue growth at the high end of our 12-15% range and are increasing our expectations for Adjusted EPS growth to 13-15%, up from 11-15% previously.

“Our strong fiscal year 2022 results are building on the double-digit top- and bottom-line growth we delivered in fiscal year 2021, and Broadridge is well positioned to deliver at the higher end of our three-year growth objectives.”