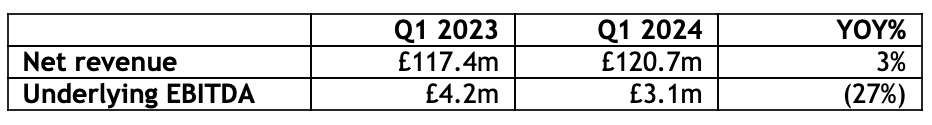

Travelex revenues grow to £120.7M to in Q1 2024

Global travel money services business Travelex International Group today announced its financial results for the three months ended 31 March 2024, reporting revenue growth driven by continued improvement in the core business and ongoing expansion in the growth regions of Asia and the Middle East and Turkey (ME&T).

The Group reported net revenues of £120.7 million (Q1 2023: £117.4 million), representing growth of 3% year on year. EBITDA declined by 27% to £3.1 million during the quarter (Q1 2023: £4.2 million), predominately due to macroeconomic conditions and the expected impact of changes to the regulatory environment in Brazil impacting margins.

Excluding Brazil, the Group’s revenues increased by 8% (£7.8m) and EBITDA by 178% (£1.2m) year on year.

The Asia business has reported impressive growth year on year, with revenues up 57% to £18.4 million (Q1 2023: £11.8 million) and EBITDA up 119% to £5.9 million (Q1 2023: £2.7 million). This is in part due to the continued recovery of travel in the region, driving growth in the Retail businesses in Japan, China and the Hong Kong market, but also the strong performance of the Group’s Wholesale business in the Asia region.

The Retail businesses in the ME&T region continues to be strong. As a region, it was the second highest contributor to Group revenues during the quarter, delivering net revenues of £23.4 million, up 12% year on year (Q1 2023: £20.9 million). EBITDA in the ME&T region was up 27% year on year to £5.4 million (Q1 2023: £4.3 million).

The Group’s global Wholesale business reported a revenue increase of 22% and EBITDA growth of 10% (Q1 2024: £5.9 million; Q1 2023: £5.4 million). This was driven predominantly by Asia, following the investment into the cash processing centre in Hong Kong, and also due to the continued growth in ME&T.

Net revenues from the UK business were down 6% (Q1 2024: £32.1 million; Q1 2023: £34.3 million), partly as a result of the reduction of regional airports during 2023 and some lower retail volumes in the first quarter of 2024.

Net revenues were up 4% in Australia and New Zealand (ANZ), to £14.1 million (Q1 2023: 13.6 million), however EBITDA declined to £1.2 million (Q1 2023: £2.5 million) as a result of normalisation of rental contracts following rental benefits in the prior year.

Richard Wazacz, CEO of Travelex, commented:

“We saw impressive growth in Asia, the Middle East and Turkey, where travel continues to recover but also where our recent investment and successes are bearing fruit. The potential for further growth in these markets is evident, including our recent win with Changi Airport, expansion in Abu Dhabi, and our Hong Kong cash processing investment already delivering strong results.

Structural tailwinds, such as the continued growth of international passenger traffic within key travel corridors, underpins the growth opportunity for the Group. I am confident that this, combined with Travelex’s unique brand positioning, means we are well positioned to continue to deliver profitable growth.”