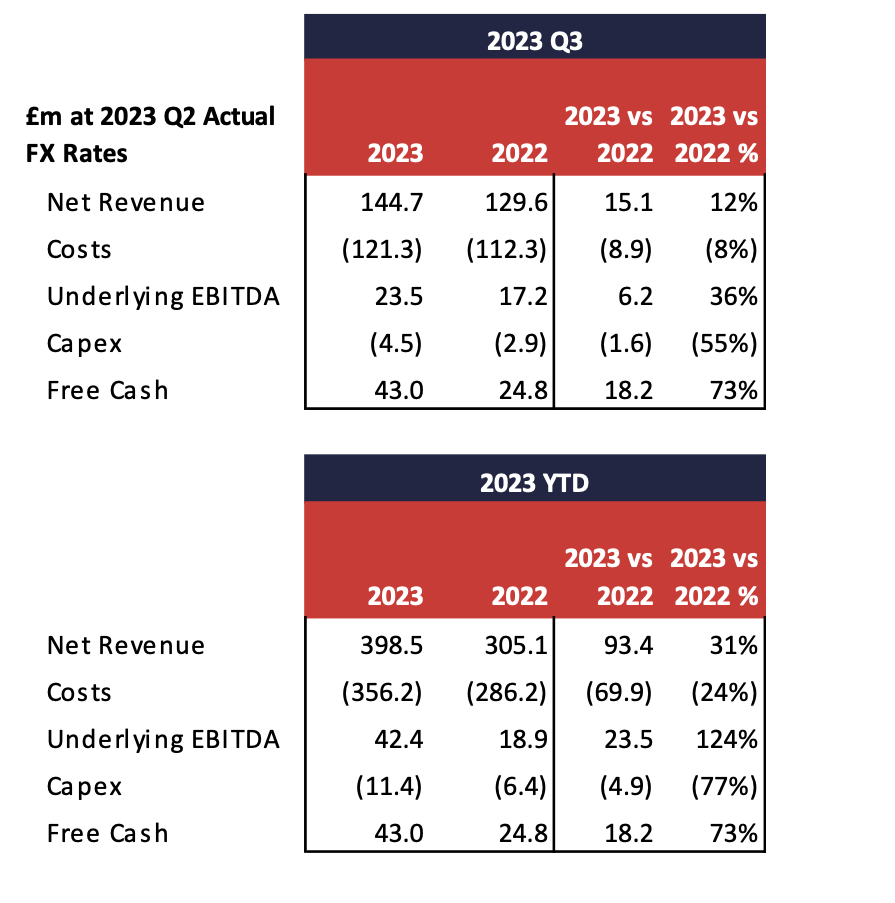

Travelex registers 12% Y/Y rise in revenues in Q3 2023

Travelex today reported its financial results for the third quarter of 2023.

The Travelex International Group generated revenues of £144.7 million in Q3 2023, £8.3 million higher than Q2 and £15.1m (12%) greater than 2022. Year-to-date revenues of £398.5 million were £93.4 million (31%) above 2022.

The Travelex International Group produced underlying EBITDA in the quarter of £23.5m, £6.2m favourable to Q3 2022, while year to date underlying EBITDA of £42.4m was £23.5m favourable to 2022.

The third quarter is the Travelex International Group’s traditional peak trading period and continuing the trend from the second quarter, strong revenue and underlying EBITDA growth was evident across the Travelex International Group. The Retail businesses in Asia Pacific continued to benefit from increased passenger numbers after the easing of restrictions in Japan, Hong Kong and China as well as progress in other regions where recovery was already well under way in 2023.

Costs of £121.3m in the quarter were aligned to Q2 and £8.9m greater than 2022 demonstrating focused investment in trading staff and third-party costs to support revenue growth as well as increases in rent aligned with trading volumes.

2023 revenues of £398.5m are only £7.8m adverse to 2019 levels (£406.3m) despite some regions still recovering, while underlying EBITDA of £42.4m is £16.4m favourable to 2019 (£26.0m) driven by savings on staff and variable trading costs.

YTD Capex of £11.4m was £6.4m greater than 2022 driven by investments in Retail stores and IT infrastructure.

Free cash of £43.0m was £18.2m higher than 2022 following the completion of the refinancing of its existing £50m senior facilities agreement with a new £90m facility in September 2023. Excess cash has been invested into tills and vaults as the business continues to capitalise on increased demand across the Retail and Wholesale networks.