Paysafe reports rise in revenues in Q3 2022

Specialized payments platform Paysafe Limited (NYSE:PSFE) today announced its financial results for the third quarter of 2022.

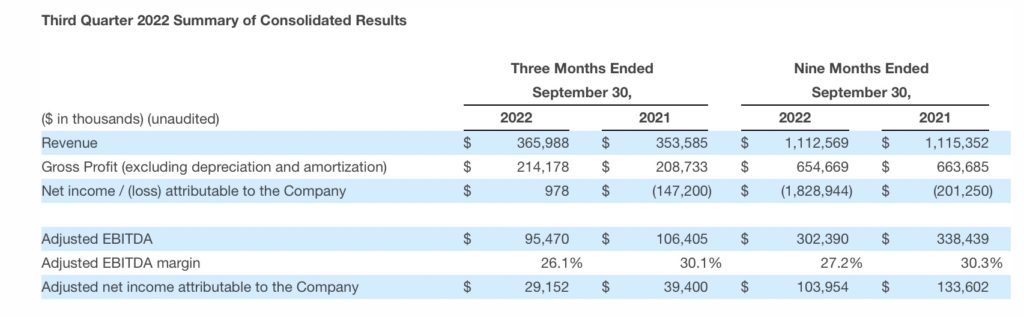

Total revenue for the third quarter of 2022 was $366.0 million, an increase of 4%, compared to $353.6 million in the prior year period, driven by strong revenue growth from US Acquiring, which increased 12%, partly offset by Digital Commerce, which declined 4%.

Excluding a $23.0 million unfavorable impact from changes in foreign exchange rates, total revenue increased 10% compared to the prior year period. Digital Commerce revenue increased 8% on a constant currency basis, reflecting growth from acquisitions completed in the last twelve months and growth from new products.

Net income attributable to the company for the third quarter was $1.0 million, compared to a net loss of $147.2 million in the prior year period. The increase in net income largely reflects the intangible impairment expense in the prior year.

Adjusted EBITDA for the third quarter was $95.5 million, a decrease of 10%, compared to $106.4 million in the prior year period.

Adjusted net income for the third quarter was $29.2 million, compared to $39.4 million in the prior year period. The change in adjusted net income was largely attributable to higher interest expense as well as the decline in Adjusted EBITDA.

Third quarter net cash outflow from operating activities was $6.2 million, compared to net cash inflow of $51.6 million in the prior year period, mainly reflecting the timing of settlement of customer funds. Free cash flow was $106.5 million, compared to $70.2 million in the prior year period.

Today Paysafe also announced that it intends to hold a special meeting of shareholders on December 8, 2022 to seek approval for a 1-for-12 reverse stock split of the company’s common shares and a corresponding decrease in the total number of authorized shares. If approved by shareholders, the reverse split is expected to be completed prior to year-end.

The Board reserves its right to delay the implementation or elect not to proceed with the reverse stock split if it determines that implementing a reverse split is no longer in the best interests of the Company and its shareholders.