Paysafe registers increase in revenues in Q1 2024

Payments platform Paysafe Limited (NYSE:PSFE) today announced its financial results for the first quarter of 2024.

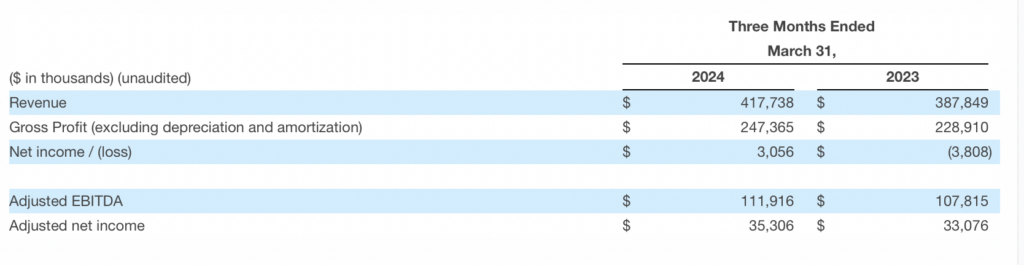

Total revenue for the first quarter of 2024 was $417.7 million, an increase of 8%, compared to $387.8 million in the prior year period, reflecting 7% growth in total payment volume. Excluding a $2.1 million favorable impact from changes in foreign exchange rates, total revenue increased 7%.

Revenue from the Merchant Solutions segment increased 11%, reflecting double-digit growth in e-commerce as well as growth from small and medium-sized businesses (“SMBs”) driven by initiatives to expand our sales capabilities and optimize the portfolio. Revenue from the Digital Wallets segment increased 5% as reported and 4% in constant currency, reflecting growth from gambling merchants as well as ongoing initiatives related to product and consumer engagement.

Net income for the first quarter increased to $3.1 million, compared to a net loss of $3.8 million in the prior year period. An increase in expenses for depreciation and amortization, share-based compensation, and taxes was more than offset by an increase in other income as well as a decrease in interest expense, which declined by $2.5 million, despite higher interest rates year-over-year, partly reflecting our focus on reducing debt.

Adjusted net income for the first quarter increased 7% to $35.3 million, compared to $33.1 million in the prior year period.

Adjusted EBITDA for the first quarter was $111.9 million, an increase of 4%, compared to $107.8 million in the prior year period. Excluding a $0.4 million favorable impact from changes in foreign exchange rates, Adjusted EBITDA increased 3%, primarily reflecting revenue growth, partially offset by incremental expenses related to previously announced initiatives to expand the sales team and optimize the portfolio as well as higher severance and credit loss expense.

First quarter operating cash flow was $58.8 million, compared to $20.0 million in the prior year period, which was mainly driven by lower taxes paid and the timing of bonus payments. Unlevered free cash flow was $69.2 million, compared to $42.2 million in the prior year period.

As of March 31, 2024, total cash and cash equivalents were $202.1 million, total debt was $2.5 billion and net debt was $2.3 billion. Compared to December 31, 2023, total debt decreased by $44.5 million, reflecting net repayments of $14.6 million as well as movement in foreign exchange rates.