Paysafe registers 6% Y/Y increase in revenues in Q2 2023

Payments platform Paysafe Limited (NYSE:PSFE) today announced its financial results for the second quarter of 2023.

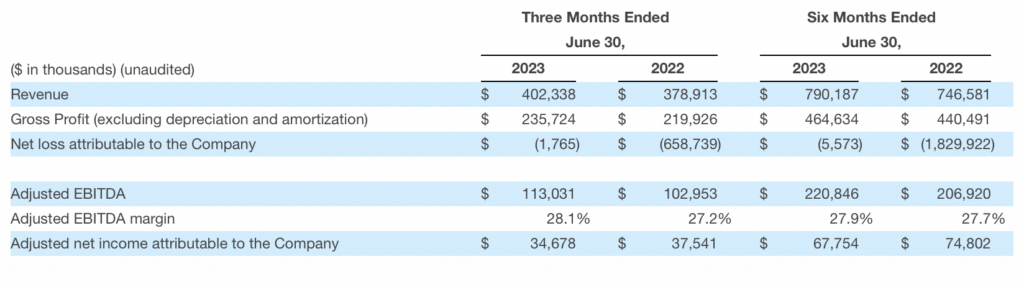

Total revenue for the second quarter of 2023 was $402.3 million, an increase of 6%, compared to $378.9 million in the prior year period, reflecting 6% growth in total payment volume. Excluding a $3.2 million favorable impact from changes in foreign exchange rates, total revenue increased 5%.

Revenue from the Merchant Solutions segment increased 6%, driven by small and medium-sized business (SMB) volume in North America and strong growth from iGaming in the region. Revenue from the Digital Wallets segment increased 6% on a reported basis and 5% on a constant currency basis, driven by classic digital wallets supported by the Company’s improvements to increase consumer engagement and merchant checkout conversion rates as well as the contribution of interest revenue on consumer deposits.

Net loss attributable to the Company for the second quarter was $1.8 million, compared to $658.7 million in the prior year period. The decrease in net loss primarily reflects an impairment of goodwill recognized in the prior year period.

Adjusted net income for the second quarter was $34.7 million, compared to $37.5 million in the prior year period, reflecting an increase in interest expense which increased by $8.3 million to $36.8 million for the second quarter of 2023 from $28.4 million in the prior year period.

Adjusted EBITDA for the second quarter was $113.0 million, an increase of 10%, compared to $103.0 million in the prior year period. Excluding a $1.0 million favorable impact from changes in foreign exchange rates, Adjusted EBITDA increased 9% compared to the prior year period. Adjusted EBITDA margin for the second quarter increased to 28.1%, compared to 27.2% in the prior year period, reflecting higher gross margins in the Digital Wallets segment as well as operating leverage.

Second quarter net cash used in operating activities was $233.9 million, compared to an inflow of $875.6 million in the prior year period, mainly reflecting the timing of settlement of funds payable and amounts due to customers. Free cash flow was $94.7 million, compared to $39.7 million in the prior year period, which includes the movement in customer accounts and other restricted cash which was an increase of $302.6 million in the second quarter of 2023, compared to a decrease of $849.7 million in the prior year period.

Bruce Lowthers, CEO of Paysafe, commented:

“We are pleased with our results through the first half of 2023, including 6% revenue growth and 7% Adjusted EBITDA growth, driven by strong volumes across SMB and e-commerce, particularly North America iGaming, as well as progress in classic digital wallets, where we continue to see improved user engagement.

Based on our results to date, we are raising our full year 2023 revenue growth outlook to the range of 6.5% to 7.5%, while maintaining more than 100 basis points in Adjusted EBITDA margin expansion this year.”