Paysafe registers 5% rise in revenues in Q1 2021

Specialized payments platform Paysafe Ltd (NYSE:PSFE) today announced its financial results for the first quarter of 2021.

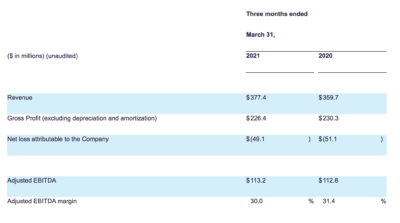

Total revenue for the first quarter of 2021 was $377.4 million, an increase of 5%, compared to $359.7 million in the prior year. The increase in revenue primarily reflects growth across the eCash business, which more than offset lower revenue from the Digital Wallet business. The impact of businesses divested during the last twelve months had a negative impact of 2%, compared to the prior year.

Revenue performance also reflects the impact of actions taken in 2020 to improve the Company’s overall risk/reward profile in certain markets and channels, which had an unfavorable impact on year over year growth.

Net loss attributable to the Company for the first quarter was $49.1 million, compared to $51.1 million, in the prior year. Results included interest expense of $58.5 million, an increase of 53% compared to the prior year, reflecting the expense of capitalized debt fees as a result of debt repayment on March 31, 2021. Net loss also included share-based compensation of $72.4 million.

Additionally, the first quarter of 2020 included an impairment charge of $53.0 million, related to Integrated Processing intangible assets.

Adjusted EBITDA for the first quarter was $113.2 million, compared to $112.8 million in the prior year. Adjusted EBITDA margin decreased approximately 140 basis points to 30.0%, primarily due to changes in merchant and revenue mix in Integrated Processing and Digital Wallet, offset by eCash Solutions margin expansion.

On March 30, 2021, Paysafe completed the previously announced transaction with FTAC, a special purpose acquisition company, which resulted in Paysafe Limited acquiring, and becoming the successor to, the Accounting Predecessor. Simultaneously, it completed the merger with FTAC with an exchange of the shares and warrants issued by Paysafe Limited for those of FTAC.

The acquisition was accounted for as a capital reorganization followed by the merger with FTAC, which was treated as a recapitalization. Following the transaction, both the Accounting Predecessor and FTAC are indirect wholly owned subsidiaries of Paysafe Limited.

Upon completion of the Transaction, the common stock and warrants began trading on the New York Stock Exchange under the ticker symbols “PSFE” and “PSFE WS,” respectively, on March 31, 2021.

Philip McHugh, CEO of Paysafe, stated,

“As we embark on our next chapter as a public company, we are pleased to deliver solid financial results in the first quarter, including continued strength from online and e-commerce volumes. Alongside this, we made excellent progress on our strategic initiatives across North American iGaming and emerging eCommerce verticals, while achieving milestones to further scale our platform and unlock value. Looking ahead, with our great market positions and unique, two-sided network, we believe that Paysafe remains well positioned to deliver consistent double-digit growth and drive operating leverage.”