Installment payment platform Sezzle reports solid operating metrics for Q3 2020

Installment payment platform Sezzle Inc (ASX:SZL) today posted its key operating metrics for the third quarter of 2020, with Underlying Merchant Sales (UMS) marking an increase in annual and quarterly terms.

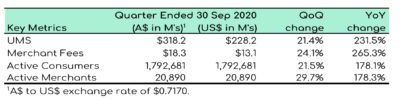

- During the quarter to the end of September 2020, UMS increased 231.5% from the same period a year earlier to US$228 million (A$318 million). The result was up 21.4% from the preceding quarter.

- Further, Merchant Fees as a % of UMS improved to 5.8% in the third quarter of 2020 compared to 5.6% in the preceding quarter and 5.2% in the third quarter of 2019.

- The number of Active Consumers for the third quarter of 2020 rose 178.1% from a year earlier to 1.79 million. The rise from the previous quarter was 21.5%.

- Active Merchants increased 178.3% in annual terms to 20,890 (+29.7% in quarterly terms).

Regarding the company’s accomplishments during the third quarter of 2020, let’s note that Sezzle raised US$58.3 million (net of offer costs) in July and August 2020 via an Institutional Placement and Securities Purchase Plan, in order to accelerate growth and strengthen its balance sheet.

The company also entered into a strategic partnership with Ally Lending. The collaboration will provide a long-term financing solution to Sezzle’s merchants and consumers (up to 60 months and US$40,000 per installment). The consumer financing provided by Ally will be maintained on Ally’s balance sheet. The product partnership with Ally is expected to begin in the first quarter of 2021 and was signed for a 5-year initial term.

Today, Sezzle reiterated its UMS guidance of achieving an annualized run rate in excess of US$1.0 billion by the end of 2020.