Virtu Financial registers 30.7% drop in revenues in Q1 2022

Virtu Financial, Inc. (NASDAQ:VIRT) today reported results for the first quarter ended March 31, 2022.

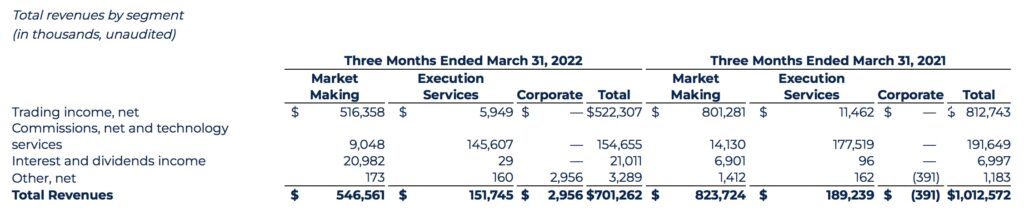

Total revenues decreased 30.7% to $701.3 million for this quarter, driven primarily by lower trading volumes in U.S. equities, compared to $1,012.6 million for the same period in 2021.

Trading income, net, decreased 35.7% to $522.3 million for this quarter, compared to $812.7 million for the same period in 2021. Net income totaled $199.9 million for this quarter, compared to net income of $409.2 million in the prior year quarter.

Basic and diluted earnings per share for this quarter were $0.99 and $0.98, compared to a basic and diluted earnings per share of $1.91 and $1.89, respectively, for the same period in 2021.

Adjusted Net Trading Income decreased 30.6% to $505.1 million for this quarter, compared to $728.0 million for the same period in 2021. Adjusted EBITDA decreased 39.1% to $343.8 million for this quarter, compared to $564.7 million for the same period in 2021.

Normalized Adjusted Net Income, removing one-time integration costs and non-cash items, decreased 42.3% to $231.8 million for this quarter, compared to $401.6 million for the same period in 2021.

As of March 31, 2022, Virtu had $612.7 million in cash, cash equivalents and restricted cash, and total long-term debt outstanding in an aggregate principal amount of $1,828.8 million.

On January 13, 2022, the company completed issuance of a $1.8 billion senior secured first lien term loan due in 2029. The credit agreement provides (i) a senior secured first lien term loan in an aggregate principal amount of $1.8 billion, drawn in its entirety on the Credit Agreement Closing Date, the proceeds of which were used to repay all amounts outstanding under the prior $1.6 billion first lien term loan facility, and to pay related fees and expenses, with the remainder of the proceeds to be used to fund share repurchases under the Company’s repurchase program and for general corporate purposes, and (ii) a $250.0 million senior secured first lien revolving facility to VFH, with a $20.0 million letter of credit subfacility and a $20.0 million swingline subfacility.

Since inception of the share repurchase program in November 2020 through April 25, 2022, the Company repurchased approximately 25.2 million shares of Class A Common Stock and Virtu Financial Units for approximately $731.6 million. The Company has approximately $488.4 million remaining capacity for future purchases of shares of Class A Common Stock and Virtu Financial Units under the program.