Tradeweb registers 8% Y/Y rise in revenues in Q3 2022

Tradeweb Markets Inc. (NASDAQ:TW), a global operator of electronic marketplaces for rates, credit, equities and money markets, today reported financial results for the quarter ended September 30, 2022.

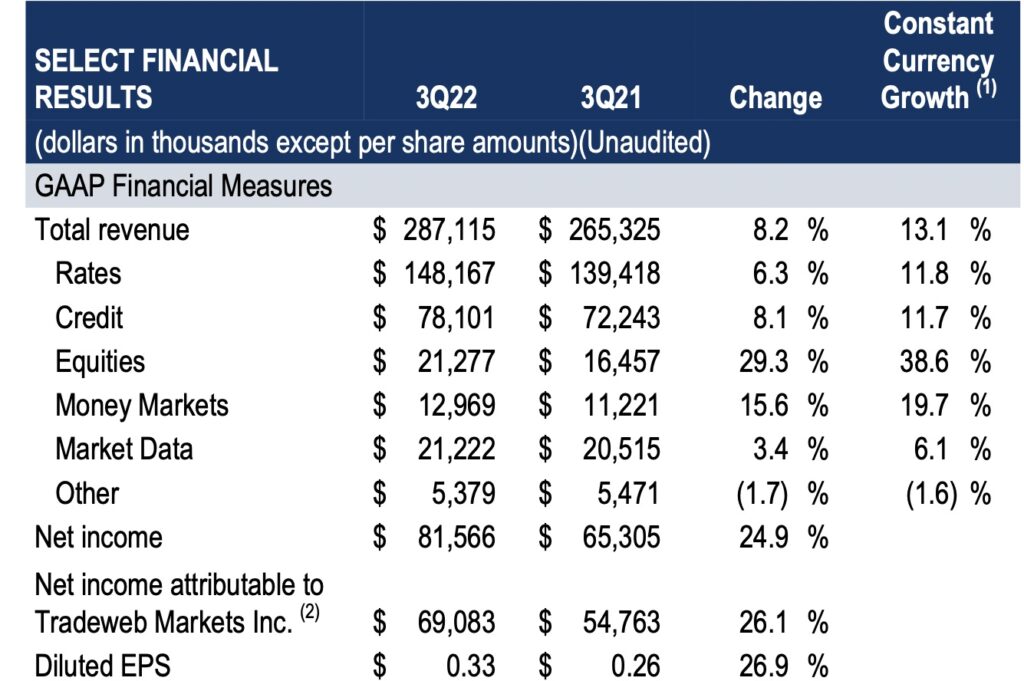

Tradeweb posted $287.1 million in quarterly revenues, an increase of 8.2% (13.1% on a constant currency basis) compared to prior year period.

Equities revenues amounted to $21.3 million in the third quarter of 2022, an increase of 29.3% from the result registered a year earlier. Equities ADV was up 8.7% with record ADV in equity convertibles/swaps/options. Equities performance reflected increased global institutional client activity driven by further adoption of RFQ and continued market volatility.

Money Markets revenues reached $13.0 million in the third quarter of 2022, up 15.6% from the prior year period (19.7% on a constant currency basis). Money Markets ADV was up 16.7% led by strong client adoption of Tradeweb’s electronic trading solutions and retail money markets activity, which increased over the third quarter and culminated with a monthly record in September.

Market Data eevenues of $21.2 million in the third quarter of 2022 increased 3.4% compared to prior year period (6.1% on a constant currency basis). The increase was derived from increased third party market data fees and Refinitiv market data fees.

Net income for the third quarter of 2022 reached $81.6 million, whereas adjusted net income was $106.5 million, increases of 24.9% and 13.1% respectively from prior year period.

The company reported diluted earnings per share (“Diluted EPS”) of $0.33 for the quarter and adjusted diluted earnings per share of $0.45.

The Board of Directors of Tradeweb Markets Inc. declared a quarterly cash dividend of $0.08 per share of Class A common stock and Class B common stock. The dividend will be payable on December 15, 2022 to stockholders of record as of December 1, 2022.

Lee Olesky, Chairman and CEO of Tradeweb Markets commented:

“Tradeweb reported record third quarter revenues driven by strong trading volumes across asset classes and products. Despite challenging markets, we delivered double-digit revenue growth on a constant currency basis in rates, credit, equities and money markets. Our clients leveraged a wide range of electronic tools and protocols to help advance their trading strategies as markets reflected concerns around inflation and geopolitical conflict. Client engagement was strong across all of our markets and we’ve seen increased interest in electronifying markets that have been persistently analog, like swaps and repos.

As I prepare to retire as CEO at year-end and stay on as chairman, I am proud that Tradeweb has continued to grow, innovate and collaborate with our clients to make markets more efficient. Billy Hult and our leadership team are well positioned to drive our next wave of growth, and I can’t wait to see what comes next. I am grateful to our clients and employees for their confidence and support.”