Standard Chartered marks rise in FX income in Q4 2020

Standard Chartered PLC (LON:STAN) today reported its financial results for the final quarter and full year of 2020, with financial markets income marking a rise.

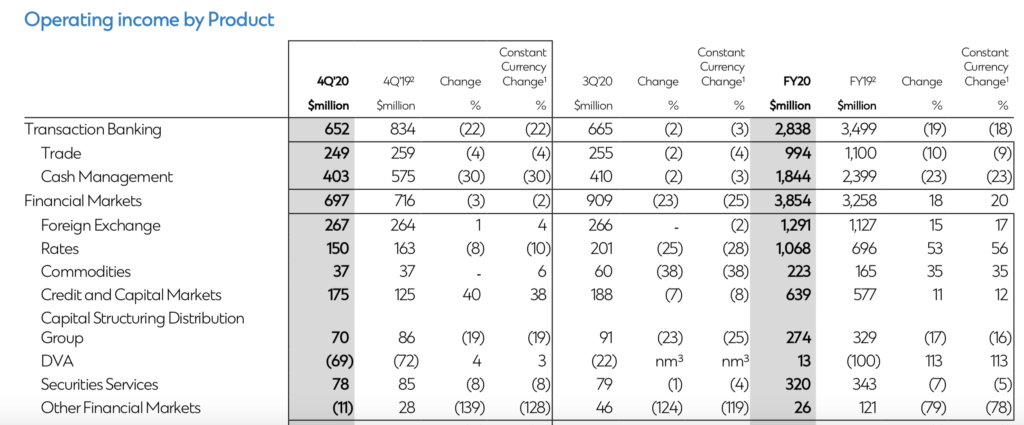

In full year 2020, Financial Markets income grew 18%, or 14% excluding DVA, benefiting from market volatility and increased hedging and investment activity by clients. There was strong double-digit growth in Rates, Foreign Exchange and Commodities. Full-year FX income reached $1,291 million, up 17% in constant currencies.

In the fourth quarter of 2020, FX income was $267 million. This is 4% higher than in the equivalent period a year earlier in constant currencies. The result for the final quarter of 2020 is also better than in the third quarter of 2020.

Across all segments, full-year operating income declined 3% and was down 2% on a constant currency basis. Net interest income decreased 11% with increased volumes more than offset by a 19 per cent or 31 basis point reduction in net interest margin.

Profit from associates and joint ventures decreased by 35% to $164 million. The Group could only recognise its share of the profits of its associate China Bohai Bank for ten months due to the timing of its recently completed initial public offering in July 2020. The Group’s share of Bohai’s annual preference share dividend, $22 million, was deducted from its share of profit in 4Q’20.

Profit before tax decreased 40% or 39% on a constant currency basis. Statutory profit before tax ell 57% driven by charges totalling $895 million relating to restructuring, goodwill impairment – including $489 million principally relating to India and United Arab Emirates – and other items.

Underlying basic earnings per share (EPS) reduced 52% to 36.1 cents and statutory EPS declined 46.6 cents to 10.4 cents.

A final ordinary dividend of 9 cents per share has been proposed, which along with the announced share buyback program of $254 million is the maximum the Group is authorised by its regulator to return to shareholders currently, being 0.2 per cent of risk-weighted assets as at 31 December 2020.