LMAX reports 5% Revenue decrease in 1H-2020

LMAX Group, which operates institutional execution venues for FX and crypto currency trading, has come out with a statement about its results from the first half of 2020. While LMAX reported what it calls “record results” for the six months ended 30 June 2020 (which we believe they got to by comparing 1H-2020 to 1H-2019), our analysis at FNG shows that Revenue and Profits actually declined slightly at LMAX during 1H-2020, as compared to the second half of 2019.

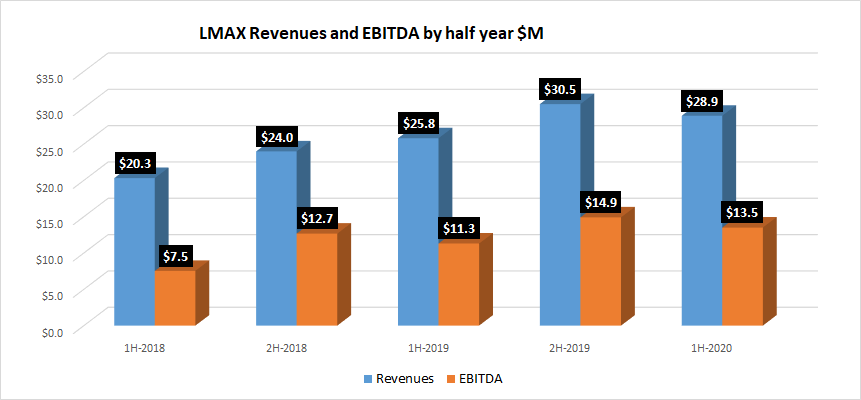

Revenue (which LMAX calls Gross Profit) was off by 5%, to $28.9 million in 1H-2020, as compared to a record $30.5 million LMAX brought in during the second half of 2019. EBITDA declined by 9%, $13.5 million versus $14.9 million in 2H-2019. Both figures were, however, improved from the first half of 2019.

The overall long-term trend at LMAX is certainly up, but we do find LMAX’s results somewhat surprising – in the Retail FX space (and institutional as well) we are seeing companies report some eye-popping figures for the first half of calendar 2020. Volumes and new client signups have soared in the Retail FX space during the market volatility being experienced during the current Covid-19 crisis.

LMAX said that it saw total FX trading volumes of $2.3 trillion in 1H-2020 (or an average of $383 billion monthly), up 33% from H1 2019. LMAX saw very healthy growth in its institutional crypto and crypto-liquidity business, with total spot crypto currency volumes of $36 billion (or $6 billion monthly), up 106% from H1 2019.

The company said that its performance was underpinned by growth in the institutional FX market globally, which saw increased trading on LMAX Exchange by banks, non-banks and investment managers via bank algos:

- Institutional FX volumes up 66% from H1 2019

- Investment manager segment (trading via bank algos): volumes up 108% from H1 2019

- Geographically, North America saw the highest growth with trading volumes on LMAX Exchange (NY4) increasing 165% compared to the first half of 2019.

LMAX Digital, the company’s cryptocurrency exchange, also performed strongly with trading volumes up 106% and the exchange seeing record numbers of new clients. It now works with more than 200 large global institutions trading crypto currencies in the US, Europe and Asia.

David Mercer, CEO of LMAX Group, said:

“These record results illustrate the success of our distinctive business model. Our institutional segment continues to demonstrate attractive growth, which, during the recent market volatility, highlights the value clients place on our order-driven firm liquidity and transparent, precise, consistent execution.”

“We have seen growth in new large institutional clients around the world trading on our execution venues and the deepening of existing relationships. This is attributed to the quality of the liquidity and execution we offer across exchanges, and the resilience of our technology infrastructure, which has performed well through the pandemic.”

“We continue to look for ways to revolutionise capital markets, with some notable successes. In the two years since LMAX Digital launched, it has become the leading crypto currency exchange for institutional market participants and has secured its position as the primary price discovery venue. LMAX Weekend FX service, which launched in June 2020, enables market participants to capitalise on FX movements over the course of a weekend, and is already showing early encouraging signs.”

“We are pleased with these record results, but we remain future focused. Despite the uncertain global economic outlook, LMAX Group remains well positioned to continue on its current growth trajectory. We will achieve this by serving the evolving needs of our clients across the breadth of our unique offering, while making targeted investments in strategic growth opportunities.”

July 17, 2020 @ 1:23 pm

so why was revenue down? you don’t explain

July 17, 2020 @ 1:30 pm

is about margins. institution spread and margin is being squeeze, ultracompetitive. retail brokers are making all the money now.

March 30, 2021 @ 10:23 pm

same problem as many retail brokers – lotsa volume but losses on market making with uneven trading, all retail clients long long long.