Plus500 revenues hit $247M in Q2, David Zruia confirmed CEO

It is rare that the market cheers a 22% quarter-to-quarter decline in Revenue for a publicly traded company, but that is exactly what is happening this morning at Plus500.

The FCA licensed broker is seeing its shares trade up by about 6% to a 52-week high of just above £14 a share in early LSE trading, following the release this morning of Plus500’s first half trading update (see text below). In the update the company also confirmed interim CEO David Zruia (pictured above) as the company’s permanent CEO. Mr. Zruia had been COO of Plus500 since 2013, and was named interim CEO in April of this year following the departure of Asaf Elimelech.

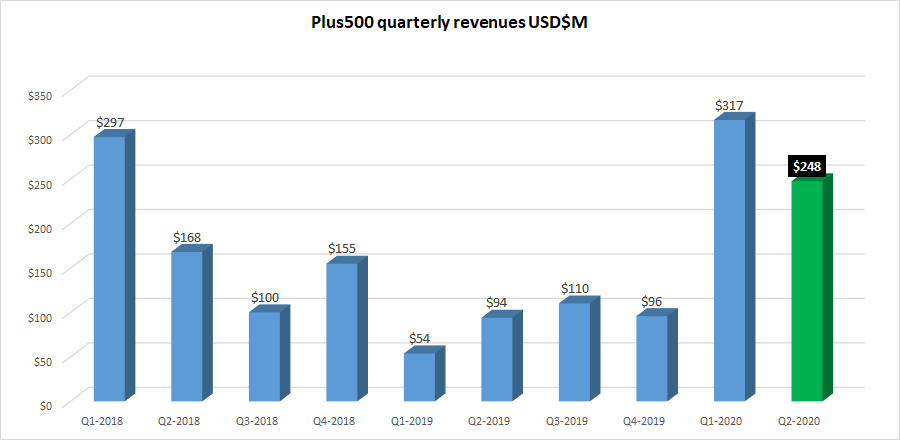

Back to the numbers, Plus500 reported that Q2 revenues came in at $247.6 million, which followed a record $317 million in Q1. As you can see in the following graph, Plus500 has quite a lot of variability in its quarterly top line, with revenues usually correlating highly to overall financial market volatility.

As we noted above, although Q2 revenues came in 22% below Q1 it is being viewed as another strong quarter for Plus500, indeed one of its three-best ever. Fueling the market’s optimism about the future, Plus500 noted that it onboarded 115,225 new customers in Q2 2020, an absolutely staggering figure, at what the company called an “attractive cost”.

The full text of Plus500’s Q2 / First Half 2020 Trading Update follows:

7 July 2020

Plus500 Ltd.

Appointment of CEO and Half Year Trading Update

Plus500, a leading technology platform for trading Contracts for Difference (“CFDs”) internationally, today issues the following trading update for the six months ended 30 June 2020, as well as the appointment of a permanent Chief Executive Officer.

Appointment of CEO

Following an extensive internal and external search carried out by the Board, the Company announces that David Zruia has been appointed as permanent Chief Executive Officer, having held the role on an interim basis since 20 April 2020. David joined Plus500 in 2010 and was appointed Chief Operating Officer in 2013.

Half Year Trading Update

Further to the Company’s recent trading updates, issued on 28 April 2020 and 8 June 2020, market volatility remained heightened throughout the second quarter. This drove a consistently high level of customer trading activity which, together with the onboarding of a significant number of New Customers1 at an attractive cost, ensured a record number of Active Customers2 trading on the Plus500 platform during H1 2020. 198,176 New Customers were onboarded during H1 2020 (H1 2019: 47,540), including 115,225 New Customers in Q2 2020 (Q2 2019: 26,234).

As a result, total revenue for H1 2020 was circa $564.2m3 (H1 2019: $148.0m), including circa $247.6m3 in Q2 2020 (Q2 2019: $94.1m), demonstrating the strength, scalability and differentiation of the Group’s business model. The Company achieved a record level of half yearly Customer Income4, of approximately $556.9m (H1 2019: $175.0m), including circa $323.4m in Q2 2020 (Q2 2019: $93.0m). Furthermore, the period-end position of Customer Trading Performance5 reverted to insignificant historical levels, with revenues from Customer Trading Performance representing approximately 1% of the total revenues in the period.

The unprecedented market environment during the period, the consistently high level of quality and performance of Plus500’s market-leading proprietary technology platform and the continued dedication and hard work of our employees in extremely challenging circumstances ensured that customer retention remained strong.

The Company’s financial position remains robust, driven by the strong EBITDA margin achieved during the period and continued high cash generation, as well as the minimal capital expenditure requirements and the low capital intensity of the business.

Despite a background of on-going uncertainty regarding the duration of current levels of volatility, and the unquantified potential impact from regulatory changes in Australia, the Board remains very confident about the outlook for the Company. A further update will be provided when the Company publishes its half-year results for the six months ended 30 June 2020 on 11 August 2020.

1 New Customers – Customers depositing for the first time during the period

2 Active Customers – Customers who made at least one real money trade during the period

3 Unaudited numbers

4 Customer Income – Revenue from customer spreads and overnight charges

5 Customer Trading Performance – Gains/losses on customers’ trading positions

Penny Judd, Chairman of Plus500, commented on David Zruia’s appointment as permanent CEO:

“David has proven his ability over several years with Plus500 as Chief Operating Officer, during which time he has developed a thorough knowledge of the business and has consistently exhibited strong leadership skills. He quickly rose to the challenge of becoming interim CEO and, consequently, he proved to be the outstanding candidate to take on the role permanently, following an extensive internal and external search process carried out by the Board. The Board is looking forward to working with David in the future and we wish him the very best in leading Plus500 going forward.”

David Zruia, Chief Executive Officer of Plus500, commented on his appointment and on the results:

“Having been part of the Plus500 team for almost 10 years, I am honoured to be given the opportunity to become CEO of the Company. It has been exciting to lead the business on an interim basis over the last few months and I believe that Plus500 is in an extremely strong position, both operationally and financially, to deliver future growth for our shareholders.

“This position is highlighted by our exceptionally strong performance during the first half of 2020. The significant number of New Customers on-boarded is a strong signal of the sophistication and accessibility of our proprietary technology platform. This performance is also a testament to our people, who have been fully committed to ensuring that we have offered our customers a consistent, seamless, high quality service in extremely challenging, and unprecedented, circumstances.

“Given our performance in the first half, we remain very confident about the prospects for the Company.”