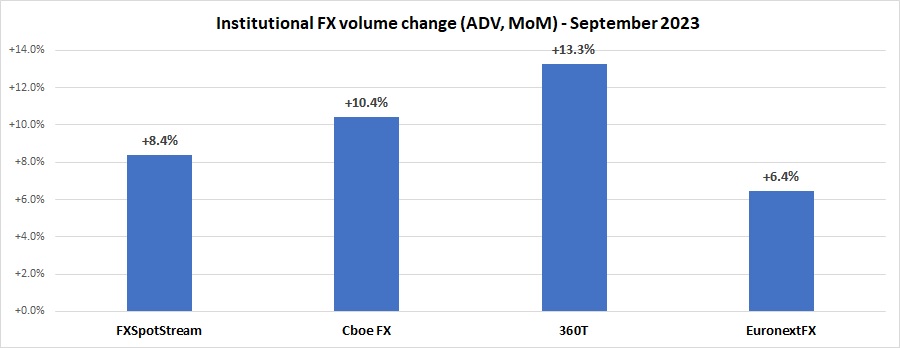

Institutional FX trading volumes see strong September, up 10%

Following a very good first half of 2023 but an expected summer slowdown, institutional FX trading volumes picked up again in September, with an average increase in trading volumes of 10% month-over-month seen at leading eFX players.

Each of the leading institutional FX venues surveyed by FNG including FXSpotStream, Cboe FX, EuronextFX and 360T saw a month-over-month increase in activity during September 2023, as rising interest rates (and speculation on continuing central bank action) injected more volatility into both equity and currency markets.

Cboe FX (formerly HotspotFX)

- September 2023 average daily volumes were $45.334 billion, +10.4% from August’s $41.062 billion.

EuronextFX (formerly FastMatch)

- September 2023 ADV $23.953 billion, +6.4% from August’s ADV of $22.503 billion.

FXSpotStream

- September’s Total ADV was USD65.9billion, with Spot ADV of USD52.2billion and Other ADV of USD13.8billion.

- FXSpotStream’s Total ADV MoM (Sep’23 vs Aug’23) increased 8.4%.

- FXSpotStream’s Total ADV YoY (Sep’23 vs Sep’22) decreased 10.03%.

- FXSpotStream’s Spot ADV MoM (Sep’23 vs Aug’23) increased 8.67%.

- FXSpotStream’s Spot ADV YoY (Sep’23 vs Sep’22) decreased 11.81%.

- FXSpotStream’s Other ADV MoM (Sep’23 vs Aug’23) increased 8.44%.

- FXSpotStream’s Other ADV YoY (Sep’23 vs Sep’22) decreased 2.63%.

360T

- Average daily volumes (ADV) at 360T came in at $29.134 billion in September 2023, up 13.3% from August’s $25.719 billion.