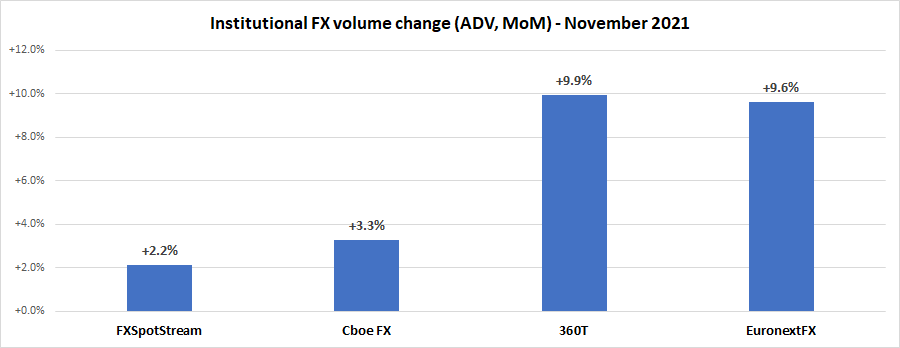

Institutional FX trading up 6% in November as Omicron drives volumes

Institutional FX trading concluded a fairly strong month of trading in November, as initial data from leading global FX ECNs is showing.

Each of FXSpotStream, Cboe FX (formerly HotspotFX), EuronextFX (formerly FastMatch), and Deutsche Borse’s 360T reported increased trading of between 2-10% in November, as compared to October, with the increase averaging 6.3% across all venues. A closer look at the data shows that November was basically flat with October, until the very last few trading days, when Omicron variant fears rattled financial markets, and sent trading volumes soaring across equities and FX. The spike in activity from November 26-30, in which daily trading was almost double daily averages, accounted for most of the aforementioned increase.

Cboe FX (formerly HotspotFX)

- November 2021 average daily volumes were $35.30 billion, +3.3% from October’s $34.17 billion.

EuronextFX (formerly FastMatch)

- November 2021 ADV $21.19 billion, +9.6% above October’s ADV of $19.32 billion.

FXSpotStream

- ADV of USD51.538billion, an increase of 2.15% vs October ’21, and replacing October as its third highest month in terms of ADV.

- November’s ADV also represents an increase of 15.8% vs November ’20 demonstrating FXSpotStream’s continued market share gains, resulting in a YoY increase every month so far in 2021 except one.

- FXSpotStream’s Overall Volume YoY (November ‘21 vs November ‘20) increased 21.31% to USD1.134trillion, crossing the USD1trillion mark for the seventh time this year

- FXSpotStream’s ADV YTD (Jan-Nov ‘21 vs Jan-Nov ‘20) increased 14.77% to USD48.932billion when compared to the same period last year

360T

- Average daily volumes (ADV) at 360T came in at $24.37 billion in November, up 9.9% from October’s $22.17 billion.